kagney-linn-karter.ru

Market

What Is The Income Limit For Education Tax Credit

You cannot claim the AOTC or Lifetime Learning Credit if your income is more than these amounts. The following additional requirements apply for the American. You are eligible to take the deduction if your modified adjusted gross income is $80, or less ($, if filing a joint return). The amount of the Tuition. Thus, for example, if an amount of $2, has been paid for eligible tuition fees for a tax year, the student is entitled to a tuition tax credit of $ for. The American Opportunity Tax Credit is a tax credit for qualified students to have some or all of their educational expenses subsidized. The Lifetime Learning Credit helps parents and students pay for undergraduate, graduate, and continuing education. You may claim up to $ for qualified. Education Tax Credit Choices American Opportunity Tax Credit is a credit for qualified education expenses paid for an eligible student for the first four. What's the education credit income limit? · Single, head of household, or qualifying widow(er) — $80,$90, · Married filing jointly — $,$, The full credit is available to individuals with a modified adjusted gross income of $80, or less, or $, or less for married couples filing a joint. You can transfer up to $5, of tuition costs to a supporting person each year. The tuition certificate you receive from your school includes a section for you. You cannot claim the AOTC or Lifetime Learning Credit if your income is more than these amounts. The following additional requirements apply for the American. You are eligible to take the deduction if your modified adjusted gross income is $80, or less ($, if filing a joint return). The amount of the Tuition. Thus, for example, if an amount of $2, has been paid for eligible tuition fees for a tax year, the student is entitled to a tuition tax credit of $ for. The American Opportunity Tax Credit is a tax credit for qualified students to have some or all of their educational expenses subsidized. The Lifetime Learning Credit helps parents and students pay for undergraduate, graduate, and continuing education. You may claim up to $ for qualified. Education Tax Credit Choices American Opportunity Tax Credit is a credit for qualified education expenses paid for an eligible student for the first four. What's the education credit income limit? · Single, head of household, or qualifying widow(er) — $80,$90, · Married filing jointly — $,$, The full credit is available to individuals with a modified adjusted gross income of $80, or less, or $, or less for married couples filing a joint. You can transfer up to $5, of tuition costs to a supporting person each year. The tuition certificate you receive from your school includes a section for you.

There is no limit on the number of years you can claim the credit. The credit is worth up to $2, per tax return. The LLC is a nonrefundable credit, which. You can claim the full American Opportunity Credit if you have at least $4, in qualified education expenses. 40% of the credit is refundable, so you may. There is a maximum income limit (currently $90, for single/head of household or $, for married filing jointly). Lifetime Learning Credit. You may be. Month and year the student first enrolled in a qualifying college or university: (see instructions for a complete list of qualifying colleges and universities). You can get a maximum annual credit of $2, per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any. You may only claim the credit to pay for “qualified education expenses,” which includes tuition paid to any accredited public, nonprofit, or privately owned. For tax paying students and parents alike, the AOTC allows a maximum credit of $2, of the cost of qualified tuition, fees, and course materials paid during. Maximum credit is $2, per eligible student · Must be enrolled at least half-time for at least one semester during the tax year at an eligible educational. The credit is worth up to $2, per eligible student per year and is available for up to four years of undergraduate study. Also read - Qualified Education. The maximum deduction is $2, a year. Using IRA Withdrawals for College Costs. You may withdraw from an IRA to pay higher education expenses. The maximum amount of the Lifetime Learning Credit is $2,, 20% of the first $10, of qualified education expenses paid per return. The income limits on the. The amount of the credit is percent of the first $2, of qualified education expenses you paid for each eligible student and 25 percent of the next $2, In , a full credit is available to single filers with a modified adjusted gross income (MAGI) below $80, and joint filers with a MAGI below $, A. The Lifetime Learning credit is a federal tax credit available to individuals who file a federal tax return and have a tax liability. A family may claim up to. Eligibility Requirements for the Lifetime Learning Credit · The taxpayer's annual modified adjusted income in is $90, or less ($, if married filing. Eligible taxpayers (student, parent or spouse) can claim the credit for % of the first $2, spent on qualified education expenses (such as tuition, fees. In , a full credit is available to single filers with a modified adjusted gross income (MAGI) below $80, and joint filers with a MAGI below $, A. Federal Tax Benefits · American Opportunity Tax Credit: Up to $2, for qualified tuition and related expenses for each eligible student. · Lifetime Learning Tax. Education Tax Credit Choices American Opportunity Tax Credit is a credit for qualified education expenses paid for an eligible student for the first four. The full credit is available to individuals whose modified adjusted gross income is $80, or less, or $, or less for married couples filing a joint.

How To Update Your Job On Linkedin

To update LinkedIn with a new job, go to your profile. Under the “Experience” section, you'll see a plus sign in the upper right corner. Click "Add position". When you decide to update your LinkedIn profile. There are a couple of places where you can include information about your lay-off. First, in the professional. The best time to update your LinkedIn profile with a new job is about two weeks after you've started your new position. Step Checklist to Update Your LinkedIn Profile · Step 1: Confirm your contact information is accurate and update if needed. · Step 2: Customize your LinkedIn. Important to know · Click the Me icon at the top of your LinkedIn homepage, then click View Profile. · Click the Edit icon to the right of the section you'd like. Under the Visibilitysection, go to Visibility of your LinkedIn activity and turn off the features that might notify the wrong people about your job search. Also. Go into Settings > Visibility > Share Profile Updates With Your Network and turn it off. That way your network won't be notified when you make. Go to your profile and select “Add profile section.” Under “Intro,” select “Looking for a new job.” From here, you can add the type of job titles you're. Most people I know wait 6 months before updating their job on LinkedIn. You never know what could happen with a new job, so it's better to just. To update LinkedIn with a new job, go to your profile. Under the “Experience” section, you'll see a plus sign in the upper right corner. Click "Add position". When you decide to update your LinkedIn profile. There are a couple of places where you can include information about your lay-off. First, in the professional. The best time to update your LinkedIn profile with a new job is about two weeks after you've started your new position. Step Checklist to Update Your LinkedIn Profile · Step 1: Confirm your contact information is accurate and update if needed. · Step 2: Customize your LinkedIn. Important to know · Click the Me icon at the top of your LinkedIn homepage, then click View Profile. · Click the Edit icon to the right of the section you'd like. Under the Visibilitysection, go to Visibility of your LinkedIn activity and turn off the features that might notify the wrong people about your job search. Also. Go into Settings > Visibility > Share Profile Updates With Your Network and turn it off. That way your network won't be notified when you make. Go to your profile and select “Add profile section.” Under “Intro,” select “Looking for a new job.” From here, you can add the type of job titles you're. Most people I know wait 6 months before updating their job on LinkedIn. You never know what could happen with a new job, so it's better to just.

I'm excited to announce that I will be taking on a new role as *name position* within the *name of team or branch of company*. During my time as a *previous. Wait at least 1 to 2 weeks before updating your job on LinkedIn. There's no right or wrong answer here, but in general, give yourself a couple of weeks to. Go to your LinkedIn settings and click on the "Privacy" tab. · Under "Job seeking preferences," click on "Let recruiters know you're open to work." · Turn on the. Click the “visibility of your LinkedIn activity” tab. Then, click the “Share profile updates with your network” option. Select your profile image > Settings from the drop-down menu. · Under Visibility of your LinkedIn activities, tap Share job changes, education. 1. Go to your LinkedIn profile. 2. Click + in the Experience section. 3. Click Add position. 4. Choose whether to notify your network. 5. Add the details of. Click on the pencil icon next to your role to edit. Update your job title to reflect your new position. LinkedIn may prompt you with "Did you get promoted? It's usually best to wait until you're a couple of weeks to a month into your role before updating LinkedIn. However, there is no hard and fast rule to say you. Go to your LinkedIn profile. Scroll down to your job experience section. Update the job position and company you got promoted in, so it reflects the changes. 1. Keep your profile up to date. It is a fact that a member with profile pictures are more likely to be visited. So make sure you take you use a good. Click the Jobs icon at the top of your LinkedIn homepage. · Click Manage job posts. · Find the job you want to edit and click the More icon to the right of the. Once you have logged into LinkedIn and accessed your profile, the next step in announcing your new job is to select the network. Here, you can. Click the Me icon at the top of your LinkedIn homepage. · Select Settings & Privacy from the dropdown. · Click the Visibility tab on the left. · Under Visibility. In this article, we'll take you through a step-by-step guide on changing your title, discuss the do's and don'ts of changing an old job title. When you decide to update your LinkedIn profile. There are a couple of places where you can include information about your lay-off. First, in the professional. So, when should you update your profile with your new position? While there's no one-size-fits-all solution, at a bare minimum, you want to wait until you have. Step 1: Trim the details about your GPA and those high school and college summer gigs. Step 2: Sell yourself based on your recent experiences and top skills. Revising your experience on a fairly regular basis—every four to six months or so—keeps you on recruiters' radars, who may be searching for certain skills and. Starting a job search on LinkedIn is more than updating your skills and profile picture. It's about engaging with people in your industry, connecting with. Under the Visibilitysection, go to Visibility of your LinkedIn activity and turn off the features that might notify the wrong people about your job search. Also.

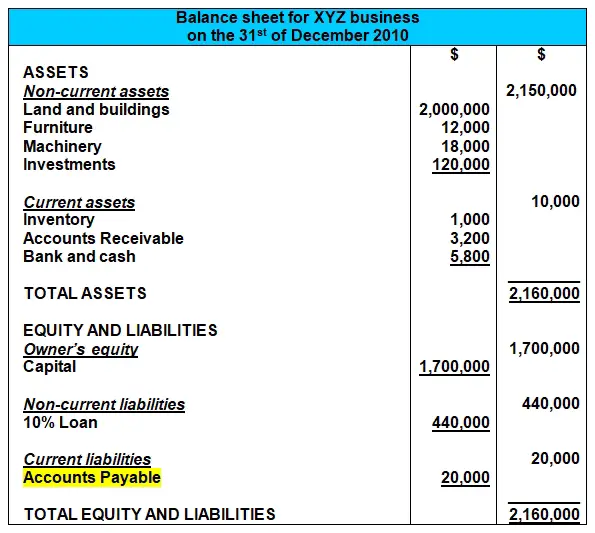

Accounts Receivable On The Balance Sheet

Accounts receivable are listed on the balance sheet of a company as a current asset. Accounts receivable may sometimes be referred to as "AR". Accounts. A higher accounts receivable amount indicates that customers are yet to pay for the products or services they've purchased. While a surge in receivables may. Accounts receivable (AR) is considered a current asset on a company's balance sheet. It represents the money that is owed to the company by its customers. An issue with the balance is typically caused by one of two things: an accounts payable or accounts receivable transaction has affected the balance sheet. Quick. Cash + Accounts Receivable. Measures liquidity: The number of dollars in Cash and. Current Liabilities. Accounts Receivable for each $1 in Current. Accounts receivable on a balance sheet represent amounts owed to a company by customers for goods or services provided on credit terms. If a company has high levels of receivables, it typically signifies that it will receive a high amount of cash in future, but that it is yet to do so. Image by. On a business's balance sheet, accounts receivable are treated as assets because they are the money the company expects to obtain from their future clients. Also known as accounts receivable, trade receivables are classified as current assets on the balance sheet. Most companies allow their customers to use. Accounts receivable are listed on the balance sheet of a company as a current asset. Accounts receivable may sometimes be referred to as "AR". Accounts. A higher accounts receivable amount indicates that customers are yet to pay for the products or services they've purchased. While a surge in receivables may. Accounts receivable (AR) is considered a current asset on a company's balance sheet. It represents the money that is owed to the company by its customers. An issue with the balance is typically caused by one of two things: an accounts payable or accounts receivable transaction has affected the balance sheet. Quick. Cash + Accounts Receivable. Measures liquidity: The number of dollars in Cash and. Current Liabilities. Accounts Receivable for each $1 in Current. Accounts receivable on a balance sheet represent amounts owed to a company by customers for goods or services provided on credit terms. If a company has high levels of receivables, it typically signifies that it will receive a high amount of cash in future, but that it is yet to do so. Image by. On a business's balance sheet, accounts receivable are treated as assets because they are the money the company expects to obtain from their future clients. Also known as accounts receivable, trade receivables are classified as current assets on the balance sheet. Most companies allow their customers to use.

Classified as a current asset on the company's balance sheet, or statement of financial position, accounts receivable is highly important since it represents. An Account Receivable is money a buyer owes the seller for a purchase when the seller delivers goods or services, before the customer pays. Accounts receivable are current assets because of the short-term nature of standard payment terms. When the outstanding invoices are paid, their value turns. Accounts receivable are dollars due from customers. They arise as a result of the process of selling inventory or services on terms that allow delivery prior to. When are Accounts Receivable Assets Used? Accounts receivable assets will be recorded in the balance sheet for the business along with other assets. The. Accounts Payable on the balance sheet represents the money a company owes to its suppliers or vendors for goods and services it has received but. balance. The presentation of Accounts Receivable and the Allowance for Doubtful Accounts on the balance sheet is often reported as follows. Accounts Receivable. Cash Flow. Although accounts receivable appears on your balance sheet as an asset, it can negatively affect your cash flow. To provide products and services to. Therefore, it is presented on the balance sheet as a current asset. Additionally, the change in accounts receivable over the period is presented in the. Accounts receivables are the receivables that are due to be received from the customers against the credit sales made or services provided on account. The. When a company has an accounts receivable balance, it means that a portion of revenue has not been received as cash payment yet. If payment takes a long time. Accounts receivable are presented in the balance sheet at net realizable value. Net realizable value equals the gross receivables less the allowance for bad. Accounts receivable is an important component of a company's financial statements, and it can be found on both the balance sheet and income statement. Receivables= Accounts Receivable Balance – Allowance for Doubtful Accounts Balance Sheet Approach (Aging the Accounts Receivables Method). Ending. Is Accounts Receivable a Revenue? Your accounts receivable balance is revenue, depending on how you construct your balance sheet. If you use cash-based. Since this amount is convertible to cash on a future date, accounts receivable is considered an asset. On a balance sheet, accounts receivable is considered a. As such, it is an asset on the balance sheet. The receivable is increased when the amount owed to the university – from donors, grantors, customers and others –. If accounts receivable increased from one year to the next, the implication is that more people paid on credit during the year, which represents a drain on. Accounts receivable are classified as current assets on a balance sheet because they are typically due within one year. However, some companies may extend. Receivables= Accounts Receivable Balance – Allowance for Doubtful Accounts Balance Sheet Approach (Aging the Accounts Receivables Method). Ending.

Can U Use Your 401k To Buy A House

Taking money out of a (k) to buy a house may be allowed, but it's not always recommended. 1. Withdrawal limits. Since there are limits on the amount you can. Some employers allow (k) loans only in cases of financial hardship, but you may be able to borrow money to buy a car, to improve your home, or to use for. I've heard it's a terrible decision to take money from k. I feel like owning property and putting equity into it could be a better long term move. Some lenders may allow you to put down as little as 0% to %, depending on your financial situation and other characteristics.2 For example, anyone buying a. Take out a bridge loan. If you depend on the equity from your home to cover the down payment on your new house, a bridge loan can help. Many financial. Plans vary in their loan stipulations; typically, the amount you can borrow depends on the account's value and maxes out at $50, An advantage of a (k). Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $, Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $, When you withdraw money from your (k), you pay taxes on the full amount of the withdrawal at your current tax rate. If you're younger than 59½ (or 55, if you. Taking money out of a (k) to buy a house may be allowed, but it's not always recommended. 1. Withdrawal limits. Since there are limits on the amount you can. Some employers allow (k) loans only in cases of financial hardship, but you may be able to borrow money to buy a car, to improve your home, or to use for. I've heard it's a terrible decision to take money from k. I feel like owning property and putting equity into it could be a better long term move. Some lenders may allow you to put down as little as 0% to %, depending on your financial situation and other characteristics.2 For example, anyone buying a. Take out a bridge loan. If you depend on the equity from your home to cover the down payment on your new house, a bridge loan can help. Many financial. Plans vary in their loan stipulations; typically, the amount you can borrow depends on the account's value and maxes out at $50, An advantage of a (k). Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $, Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $, When you withdraw money from your (k), you pay taxes on the full amount of the withdrawal at your current tax rate. If you're younger than 59½ (or 55, if you.

With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. What are the Requirements to Buy a Property with a k? Whereas IRAs can be used to invest directly in real estate, tax laws prohibit people from using their. For example, you cannot have your solo k sale the property to a third-party and you then turn around and buy it from that third-party. However, you could. You may borrow a minimum of $1, up to a maximum of $50, or 50% of your vested account balance reduced by your highest outstanding loan balance during the. If you are planning to withdraw from your (K) plan and use the money toward the purchase of your home, you will be subject to a penalty. Yes, you can borrow from your (k) plan to start a business, but only if your program administrator allows you to take out a loan. While some plans may allow you to take out more than one loan from your (k) at a time, if you do, the amount you can borrow will be reduced. For example, if. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend. Check any restrictions on how you can use the loan, such as only for education expenses, mortgage payments or medical expenses. Typically, (k) plans cap. Using an IRA withdrawal for a home purchase is possible, but there are rules. Discover the pros and cons of an IRA withdrawal to buy a home. Generally, you can use funds from your (k) to buy a house. Whether it is a good idea depends on your financial situation as there are drawbacks. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. The exception only exempts you from the penalty but not the income taxes on that first $10k. Good. Continue Reading. Most lenders will allow you to use the income from social security, trust distributions and other assets to calculate your qualifying income. How does the. First-time homebuyers can withdraw up to $10, from an IRA without incurring the 10% early-withdrawal penalty, but ordinary income taxes apply if it is from a. The exception only exempts you from the penalty but not the income taxes on that first $10k. Good. Continue Reading. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Retirement accounts are designed for you to hold until you retire. That's why it's generally difficult (and costly) to withdraw money from a retirement savings. Unlike the (K), you can withdraw up to $10, from a traditional individual retirement account (IRA) to put towards the purchase of – keyword – your FIRST. If you're using your (k) loan to buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish.

Savings Plan Calculator Apr

Estimate your savings goal. Calculate Start over. This calculator is intended for non-commercial, educational purposes. Our calculator can help you plan your consistent investments over time. This is an effective way to accumulate wealth and can help you set a saving. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. Plan your goal, calculate how much money you need to save each month, and start saving! Whatever your savings goal, using a savings growth calculator such as. plan for various federal student loans. Lady Calculating Invoice. Chartered Accountant With Calculator. Student Loan Debt/Salary Wizard. Calculate the salary. savings account calculator can help them plan. This convenient tool can be Apr 16, How Many Bank Accounts Should You Have In Canada? Personal. Use our savings calculator to estimate dividends and interest earned in a savings account, certificates of deposit and more. However, the rate they use to calculate the actual interest earned is the APR (Annual Percentage Rate) compounded daily. This can cause confusion for. Our savings interest calculator is designed with transparency in mind to help you achieve your financial goals. Initial Deposit. Recurring Deposit Amount. Estimate your savings goal. Calculate Start over. This calculator is intended for non-commercial, educational purposes. Our calculator can help you plan your consistent investments over time. This is an effective way to accumulate wealth and can help you set a saving. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. Plan your goal, calculate how much money you need to save each month, and start saving! Whatever your savings goal, using a savings growth calculator such as. plan for various federal student loans. Lady Calculating Invoice. Chartered Accountant With Calculator. Student Loan Debt/Salary Wizard. Calculate the salary. savings account calculator can help them plan. This convenient tool can be Apr 16, How Many Bank Accounts Should You Have In Canada? Personal. Use our savings calculator to estimate dividends and interest earned in a savings account, certificates of deposit and more. However, the rate they use to calculate the actual interest earned is the APR (Annual Percentage Rate) compounded daily. This can cause confusion for. Our savings interest calculator is designed with transparency in mind to help you achieve your financial goals. Initial Deposit. Recurring Deposit Amount.

Savings accounts are a great way to reach your savings goals. Use this calculator to find out how much interest you can earn. Member FDIC. How to calculate interest earned on a savings account. Know how much you're earning to better plan your savings goals. Funds in Discover Bank deposit accounts are insured for up to $, per depositor for each account ownership category. For help calculating your coverage. Plan your savings goals, find out how much you could save over time, or calculate the time, periodic amount or interest rate needed to reach your goal. Type in how much you currently have saved. · Decide on a timeline for your savings plan. · Enter your interest rate into the calculator. · Select how much extra. If you want to know the compound interval for your savings account or investment, you should be able to find out by speaking to your bank or financial. How to Use Our Savings Calculator. Initial Deposit: The first deposit you make when opening a savings account. Some savings accounts require a minimum amount. Try our easy-to-use savings calculator, mortgage payoff calculator, retirement calculators, and other financial calculators below. Calculators. Savings Goal Calculator. What will it take Terms and conditions are applied to gift cards. APY = Annual Percentage Yield, APR = Annual Percentage Rate. Calculate how much money you need to contribute each month in order to arrive at a specific savings goal. The interest that $10, would earn over a year depends on the annual percentage yield and frequency of compounding. For example, a 4% APY that's compounded. Savings Goal Calculator · 1. Click the icon below that best matches your goal: · 2. View the saving plan to reach your goal. since it changed from % to % why would i use APR for calculating the savings account interest? Upvote 2. Downvote Reply reply. A good example of this kind of calculation is a savings account because the There can be no such things as mortgages, auto loans, or credit cards without FV. Savings Goal Calculator · Required Minimum Distribution Calculator · College Savings Calculator. Compound Interest Calculator. Determine how much your money can. Use these customized calculators to see how much better off you'll be with one of our affordable loans, low-interest credit cards or high-value deposit accounts. This calculator can help you determine the future value of your savings account. Annual Interest Rate (APR %) View today's rates: Months to Invest: Tax. Discover how to reach your financial goals with the short-term savings goal calculator from Bank of America. Quickly Calculate Compound Interest. On Lump Sum and/or Regular Deposits Into a High Yield Savings Account. Your Initial Deposit.

Best App For Car Search

Best Advanced Search Functions: Autotrader Autotrader is one of the best used car sites because it's one of the most recognized car buying and selling online. Find and finance the perfect car, all with no impact to your credit score Shop & save on the go. Auto Navigator app icon. Capital One Auto Navigator. AutoTrader - Canada's Most Trusted Place to Buy and Sell Cars! The AutoTrader app brings the best automotive search experience in Canada to your iOS device. Affordable Cars Available Now. Cars Under $20, · Shop Great Deals SEARCH CARS|SITEMAP|INVESTORS|BLOG|PATENTS|PRESS|. Copyright © Carvana. Shop Toyota Certified Used Cars, Trucks and SUVs for sale at a dealer near you. Find the latest deals, models and inventory to buy hassle-free! The best deals, period. · Introducing our new search, powered by AI · Buy new and used cars or trade your old one · Flexible car buying options · Extensive. The AutoTrader app brings the best automotive search experience in Canada to your Android device. With the largest selection of vehicles in Canada. iSeeCars' award-winning used car search tool is now available on Amazon. Its tool. Find the perfect car for your needs at kagney-linn-karter.ru Shop new and used cars, sell your car, compare prices, and explore financing options to find your dream car. Best Advanced Search Functions: Autotrader Autotrader is one of the best used car sites because it's one of the most recognized car buying and selling online. Find and finance the perfect car, all with no impact to your credit score Shop & save on the go. Auto Navigator app icon. Capital One Auto Navigator. AutoTrader - Canada's Most Trusted Place to Buy and Sell Cars! The AutoTrader app brings the best automotive search experience in Canada to your iOS device. Affordable Cars Available Now. Cars Under $20, · Shop Great Deals SEARCH CARS|SITEMAP|INVESTORS|BLOG|PATENTS|PRESS|. Copyright © Carvana. Shop Toyota Certified Used Cars, Trucks and SUVs for sale at a dealer near you. Find the latest deals, models and inventory to buy hassle-free! The best deals, period. · Introducing our new search, powered by AI · Buy new and used cars or trade your old one · Flexible car buying options · Extensive. The AutoTrader app brings the best automotive search experience in Canada to your Android device. With the largest selection of vehicles in Canada. iSeeCars' award-winning used car search tool is now available on Amazon. Its tool. Find the perfect car for your needs at kagney-linn-karter.ru Shop new and used cars, sell your car, compare prices, and explore financing options to find your dream car.

make it easy to find the best car for you at the best price. Try the Free App Unlike other car shopping apps, dealers can't pay to influence our results. Explore new and used cars, trucks and SUVs with confidence. Autotrader is the one-stop shop for everything you need in your car buying experience including. kagney-linn-karter.ru gives you everything you need to research a new, certified (CPO) or used car, compare cars, find cars for sale and make a well-informed decision. We're. vehicle is inspected, certified & backed by a Ford warranty. Great financing options are also available. Find a vehicle online & test-drive at home. Autolist searches thousands of used car sites so you don't have to. With the largest selection of local cars, trucks and SUVs of any other app, download the. Search used cars, research vehicle models, and compare cars, all online at kagney-linn-karter.ru You can find the car you like and then search for dealers that have a good deal on it. The more information you have, the better decision. Looking for the best site to find a used car? Browse millions of used car Get the top-rated app! Over 7 million downloads. Trending Searches. Pickups. Shopping for a Used Car? · CARFAX Vehicle History Reports · Sell Your Car in 3 Easy Steps! · Already Own a Car? · Search for Cars by Brand · Popular Cars by Type. TrueCar lets you control your car-buying journey. Shop new & used cars, sell your car, and find all the vehicle information you need with our research. Find New & Used Cars on the CARFAX App | CARFAX. The Dealer Car Search Mobile App is the perfect solution for keeping track of your inventory. Scan vehicle VIN barcodes to quickly and easily add inventory. Search all the cars at once with AutoTempest. All the used car sites in one place, including kagney-linn-karter.ru, eBay, Truecar, Carvana and more. All the cars. Resources For Buying and Selling A Car · Edmunds True Market Value (TMV) Appraisal · Kelley Blue Book Value - KBB Value · NADA Guides' NADA Value · Edmunds Car. Automotive savings exclusively for Costco members. Go car shopping without the hassle and get low, prearranged pricing. Find an Approved Dealer near you. Find your next new car, used car, truck, or SUV including pricing and features, find a car dealer near you, calculate payments or make a service appointment. Car must be a model or newer. Access your personalized dashboard so you can see the vehicles we find for you and communicate with us. 2. If you cannot find the right finance option for the vehicle in Auto Gravity, you will find it in the Blinker. You can shop for cars, trucks, SUVs and semi-. My last search, one year ago November and December , largely used Cargurus and AutoTrader. I also used Craigslist, Ebay, and maybe one other.

Srp Empower App

SRP M-Power customers with limited incomes may be eligible to receive a $23 monthly discount. The discount is applied on the 1st of each month. Set up a payment plan or bill extension · Save $ on the Economy Price Plan · Pay as you go and save with SRP M-Power® · Uncover energy savings in your home. With the SRP M-Power mobile app, buying power is as simple as reaching into your pocket. Whether you're at home or on the go, you'll be able to make a. srp . . We have linked up to support this wonderful sounding Book via our Gym Catch app. kagney-linn-karter.ru · Može biti. Our mission is to empower creators to produce outstanding graphics in their applications. As a manager you will lead a talented team of engineers, working. These capabilities empower NetSuite users to both estimate and review GP and Mobile App Development · Integration Services · NetSuite & Celigo. The SRP Power mobile app for residential customers is a friendlier and faster way to pay your bill and manage your account. Whether you're at home or on the. The SRP M-Power app has a number of great features you can take advantage of that will make it easier to manage your account. Here are the most popular app. SRP's mobile app for residential customers is a friendlier and faster way to pay your bill and manage your account. Whether you're at home, out of town or. SRP M-Power customers with limited incomes may be eligible to receive a $23 monthly discount. The discount is applied on the 1st of each month. Set up a payment plan or bill extension · Save $ on the Economy Price Plan · Pay as you go and save with SRP M-Power® · Uncover energy savings in your home. With the SRP M-Power mobile app, buying power is as simple as reaching into your pocket. Whether you're at home or on the go, you'll be able to make a. srp . . We have linked up to support this wonderful sounding Book via our Gym Catch app. kagney-linn-karter.ru · Može biti. Our mission is to empower creators to produce outstanding graphics in their applications. As a manager you will lead a talented team of engineers, working. These capabilities empower NetSuite users to both estimate and review GP and Mobile App Development · Integration Services · NetSuite & Celigo. The SRP Power mobile app for residential customers is a friendlier and faster way to pay your bill and manage your account. Whether you're at home or on the. The SRP M-Power app has a number of great features you can take advantage of that will make it easier to manage your account. Here are the most popular app. SRP's mobile app for residential customers is a friendlier and faster way to pay your bill and manage your account. Whether you're at home, out of town or.

Learn how to cut costs and reduce your energy use with SRP rebates and discounts. SRP mobile apps: Power, M-Power and Water | SRP. Download one of three SRP. If a system error keeps you from making an M-Power payment, SRP will issue you an eCode to keep your power on for another 24 hours. Learn more. These capabilities empower NetSuite users to both estimate and review Mobile App Development · Integration Services · NetSuite & Celigo Administration. Empower Your Mobile, Global Organization. For organizations with global Access OpenAir from anywhere on the mobile app to stay informed, make. SRP starts by installing a special meter on your home. Using the free SRP M-Power® app allows you to track how much energy you've used and how much you have. However, on the M-Power plan, customers pay for their electricity before using it. This is done through an app that customers download on their phones. Overview Grow your business and empower your customers. Value Added Manage Your Devices On-the-Go with the NinjaOne Mobile App. Available on. Vs. kagney-linn-karter.ru If you are wanting to monitor your usage, download the srp app. It can give you. This exploration is designed to empower you with the knowledge to Implementing SRP in mobile app development not only clarifies the. Taylor Independent School District. Inspire, Equip, and Empower Every Student to Achieve Their Unique Potential. Home · About Us. " Taylor ISD Safety & Security. Get the SRP M-Power mobile app to help make purchases a breeze. Setting it up is easy and you can purchase power with the touch of a button anytime, anywhere. You can request an advance using the SRP M-Power mobile app, My Account, or by calling SRP at () () With each future purchase you. M-Power prepaid program · Daytime Saver pilot · How to save on time-of-day price Trade Ally rebate application support · Commercial Trade Allies portal. This exploration is designed to empower you with the knowledge to Implementing SRP in mobile app development not only clarifies the. M-Power prepaid program · Daytime Saver pilot · How to save on time-of-day Pay online using a credit card or mobile payment app. Pay your SRP electric. Advances are temporary assistance that you can request using the M-Power mobile app or by calling SRP at () () Advances are added. SRP teams use DERBI to help study participants understand their personal DERBI smartphone app on phthalates. The PROTECT SRP Center adapted DERBI. It's slightly more expensive than the basic service. You can use the SRP boxes, website, or app to pay. There is a $ deposit for the box and they don't cut. It's slightly more expensive than the basic service. You can use the SRP boxes, website, or app to pay. There is a $ deposit for the box and they don't cut. Access OpenAir from anywhere on the mobile app Real-time visibility and anytime, anywhere access to tools and information empower you to deploy the right.

Ringing The Bell On Wall Street

The NYSE bell-ringing is a public relations event that the NYSE makes available to NYSE-listed companies, as well as certain charitable organizations. Qatar Stock Exchange (QSE) today hosted a bell-ringing ceremony as part of its participation in the World Investor Week. Old Broad Street, London EC2N 1AR. Bells · Metropolitan Commercial Bank (NYSE: MCB) Rings The Opening Bell® · Zacks Investment Management Rings The Closing Bell® · Orion Group Holdings, Inc. Wall paintings · A joyful noise: the bells of Westminster Abbey · The the bells of St Margaret's Church will be ringing in the new year from pm. bell at the New York Stock Exchange on Wall Street in New York City on Thursday, September 22, Photo by John Angelillo/UPI Credit: UPI/Alamy Live News. Bob Wyatt rings the NYSE Opening Bell®. Bob Wyatt was front and center at Friday morning to ring the bell at the Exchange, with Wall Street looking on. Nasdaq Daily Bell Ceremonies. Learn more about the guests ringing the bell, watch the ceremony and view ceremony photos. Live coverage includes reports from the Chicago Board of Trade, New York Mercantile Exchange, NASDAQ and the NYSE. Analysts, money managers and CEOs explain. After that, the NYSE began inviting Hollywood celebrities and sports icons as a guest to ring the stock market bell. Eventually companies began ringing the bell. The NYSE bell-ringing is a public relations event that the NYSE makes available to NYSE-listed companies, as well as certain charitable organizations. Qatar Stock Exchange (QSE) today hosted a bell-ringing ceremony as part of its participation in the World Investor Week. Old Broad Street, London EC2N 1AR. Bells · Metropolitan Commercial Bank (NYSE: MCB) Rings The Opening Bell® · Zacks Investment Management Rings The Closing Bell® · Orion Group Holdings, Inc. Wall paintings · A joyful noise: the bells of Westminster Abbey · The the bells of St Margaret's Church will be ringing in the new year from pm. bell at the New York Stock Exchange on Wall Street in New York City on Thursday, September 22, Photo by John Angelillo/UPI Credit: UPI/Alamy Live News. Bob Wyatt rings the NYSE Opening Bell®. Bob Wyatt was front and center at Friday morning to ring the bell at the Exchange, with Wall Street looking on. Nasdaq Daily Bell Ceremonies. Learn more about the guests ringing the bell, watch the ceremony and view ceremony photos. Live coverage includes reports from the Chicago Board of Trade, New York Mercantile Exchange, NASDAQ and the NYSE. Analysts, money managers and CEOs explain. After that, the NYSE began inviting Hollywood celebrities and sports icons as a guest to ring the stock market bell. Eventually companies began ringing the bell.

The bell ringing will mark the Company's achieving $4 billion in sales in for the first time in its year history. This includes a NYSE bell that rings quite loud. Approx Dimensions: Bell -5 ¼ high, 3 ¼ at base. Approx Age: Condition: Very Good The New York Stock. The Egyptian Exchange (EGX) celebrated the inaugural of World Investor Week (WIW), Monday, October 2, , by ringing the opening bell. Black Men of America, Inc. rings NYSE closing bell The chairman of Black Men of America, Inc., Thomas W. Dortch, Jr., rang the closing bell at the New. Start the trading day right with the ringing of the opening bell Street · Opening Bell: August 30, Fri, Aug 30th watch now. Booz Allen Hamilton (NYSE:BAH) leaders, past and present, will celebrate the launch of the firm's th anniversary year by ringing The Opening Bell today. The first bell rang at the NYSE in the s with the advent of continuous trading. When the New York Stock Exchange decided the time had come cast a new bell. Explore the nyse opening bell GIFs. GIPHY Clips. Explore GIFs. Nft Pfp GIF by ringing bell GIF Coffee Robotics GIF by OpenDroids jingle bell rock GIF. RenaissanceRe Holdings Ltd. (NYSE:RNR) rang the closing bell of the New York Stock Exchange on Thursday, June 2 nd. This year RenaissanceRe is celebrating its. Specifically, we find the abnormal returns are driven almost entirely by firms who are celebrating the transfer of their stock listing to the NYSE. Given the. From tech giants to retail titans, Beyond the Ticker is a historical series that takes a deep dive into some of Wall Street's trending companies and how they. Traders work on the floor of the New York Stock Exchange at the opening bell on August 5, at Wall Street in New York City. - Stock markets slid. Live from Snoo York: @Reddit rings the opening bell! kagney-linn-karter.ru (NYSE: KORE, KORE WS) (“KORE”), a global leader in Internet of Things (IoT) solutions and worldwide IoT Connectivity-as-a-Service (CaaS), announced today that. The bell ringing will mark the Company's achieving $4 billion in sales in for the first time in its year history. When the guest ringing the bell fails to ring it We share real-world stories from people who've worked inside the financial trenches of Wall Street. Signs ByLITA Circle Please Ring Bell For Assistance Wall or Door Sign | Easy Installation | Front Desk Reception Sign (Red) - Small (1 Pack): kagney-linn-karter.ru Recent Nasdaq Stock Market Bell Ceremonies Videos · LENZ Therapeutics Rings the Nasdaq Stock Market Closing Bell · EntrepreneurShares Rings the Nasdaq Stock. ring the bell. It was only in that the NYSE began having special guests ring the bells on a regular basis; prior to that, ringing the bells was usually.

Sun Power Stock Symbol

![]()

Instrument Name Sunpower Corp Instrument Symbol (SPWR-Q). Instrument Exchange NASDAQ. SunPower Corporation (SPWR) · US NASDAQ:SPWR (M) · Be the first to know. 33 minutes ago. SunPower Lower as Earnings Forecasts Lag Expectations. SunPower shares fell after the solar-panel seller's earnings forecast lagged expectations, leading to. Sunpower Corp etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Buy Or Fear SunPower (SPWR) Stock? Financials. Track Sunpower Corp (SPWR) Stock Price, Quote, latest community messages, chart, news and other stock related information Symbol; SPWR. SPWR Sunpower. SunPower Corporation (NasdaqGS:SPWR) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest. SPWR - SunPower Corporation (NasdaqGS) - Share Price and News. SunPower Corporation. NasdaqGS. THIS SYMBOL IS NO LONGER ACTIVE. REAL TIME PRICE. EXTENDED HOURS. Instrument Name Sunpower Corp Instrument Symbol (SPWR-Q). Instrument Exchange NASDAQ. SunPower Corporation (SPWR) · US NASDAQ:SPWR (M) · Be the first to know. 33 minutes ago. SunPower Lower as Earnings Forecasts Lag Expectations. SunPower shares fell after the solar-panel seller's earnings forecast lagged expectations, leading to. Sunpower Corp etfs funds price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Buy Or Fear SunPower (SPWR) Stock? Financials. Track Sunpower Corp (SPWR) Stock Price, Quote, latest community messages, chart, news and other stock related information Symbol; SPWR. SPWR Sunpower. SunPower Corporation (NasdaqGS:SPWR) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest. SPWR - SunPower Corporation (NasdaqGS) - Share Price and News. SunPower Corporation. NasdaqGS. THIS SYMBOL IS NO LONGER ACTIVE. REAL TIME PRICE. EXTENDED HOURS.

SunPower Corporation (NasdaqGS:SPWR) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest. How to buy SunPower stock on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in. SunPower Corp (NASDAQ:SPWR) Intrinsic Valuation. Check if SPWR is overvalued or undervalued under the bear, base, and bull scenarios of the company's. SPWRQ | Complete SunPower Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Sunpower Corp stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. For the upcoming trading day on Wednesday, 11th we expect SunPower Corporation to open at $, and during the day (based on 14 day Average True Range), to. SunPower Corporation Stock Price (SPWR). SunPower Corporation is listed in the Semiconductor,related Device sector of the NASDAQ with ticker SPWR. The last. Get the latest SunPower Corporation (SPWRQ) real-time quote, historical performance, charts, and other financial information to help you make more informed. SunPower Corporation (SPWRQ.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock SunPower Corporation | OTC Markets: SPWRQ. Stock Price, News, Quote and Profile of SUNPOWER CORP(NASDAQ:SPWR) stock. General stock ratings, overview and activity description. SunPower Corporation (NASDAQ: SPWR) shares are trading lower after the company disclosed an asset purchase agreement with Complete Solaria, Inc. (NASDAQ: CSLR). SunPower and other solar names lifted by First Solar's better-than-expected results. Shares of SunPower climbed % Wednesday, with the maker of solar-energy. SunPower (SPWR) has a Smart Score of 2 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. The current stock price of SunPower Corporation (SPWR) is $ as of August 16, What is the market cap of SunPower Corporation (SPWR)?. The market cap. NOTE: The Closing Price, Day's High, Day's Low, and Day's Volume have been adjusted to account for any stock splits and/or dividends which may have occurred. SunPower Corp (SPWRQ) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. The SunPower Corp. stock price is currently $ with a total market cap valuation of $ M (M shares outstanding). The SunPower Corp. is trading. SunPower traded at $ this Tuesday April 9th, increasing $ or percent since the previous trading session. Looking back, over the last four weeks. The current stock price of SunPower Corporation (SPWR) is $ as of August 16, What is the market cap of SunPower Corporation (SPWR)?. The market cap. SunPower Corp (SPWRQ) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus.

401k Funds For Home Purchase

The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income tax. Bottom line, using those retirement funds to purchase a home can be a great option. Contact your (K) administrator to learn more about the loan and. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. In this method, the Solo (k) takes a loan from a bank or an investor to purchase the property. Like any other loan, if it is not repaid, the lender has the. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. Withdrawing money from a (k) to buy a house may be allowed by your company-sponsored plan, but this tactic is not always advisable, especially for. The real gotcha with the K is the 10% penalty for withdrawing money early. If interest rates are around 10% then it might be worth it-. The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income tax. Bottom line, using those retirement funds to purchase a home can be a great option. Contact your (K) administrator to learn more about the loan and. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. In this method, the Solo (k) takes a loan from a bank or an investor to purchase the property. Like any other loan, if it is not repaid, the lender has the. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. Withdrawing money from a (k) to buy a house may be allowed by your company-sponsored plan, but this tactic is not always advisable, especially for. The real gotcha with the K is the 10% penalty for withdrawing money early. If interest rates are around 10% then it might be worth it-.

Key Takeaways. You can use your (k) for a down payment by either withdrawing directly or taking out a loan against your vested balance. When choosing between. KEY TAKEAWAYS · You can use your (k) funds to buy a home. · Withdrawing funds from your (k) are limited to your contributions. · A (k) loan must be. Borrowing against your (k) plan should be carefully considered vs. alternative options. There are other ways to afford a home renovation that present less. The down payment required for a home purchase is the most important barrier to home ownership. Tapping a K account is a tempting method of meeting the. For those lucky enough to have significant retirement savings in a (k) or individual retirement account (IRA), dipping into those accounts to fund a home. Taking a loan from your k or borrowing from your retirement plan may seem You can borrow against the value of your home with a home equity loan or home. There are two possible options: k withdrawals and k loans. Conventional wisdom advises against withdrawing funds from your k early. However, borrowing. Borrow against your (k). Borrowing from your (k) is generally the more advantageous option if you want to tap your plan for a down payment. If your. KEY TAKEAWAYS · You can use your (k) funds to buy a home. · Withdrawing funds from your (k) are limited to your contributions. · A (k) loan must be. However, nothing is ever quite that cut and dry; options for taking a distribution vary greatly depending on your specific (k) plan's plan document—in. According to Boese, “ You are typically borrowing pre-tax funds and paying back with post-tax money. The other big negative people fail to realize is the. There are a few home-buying options besides a traditional bank loan that you might think about before pulling funds out of your (k). Low-down-payment home. The withdrawal options for a down payment on a house from a (k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a. The withdrawal options for a down payment on a house from a (k) plan are not the same a the withdrawal options from a Traditional IRA. There is also a. This may be plan-dependent, but I think you're usually limited to borrowing up to either $50k or 50% of your vested value, whichever is lower. There are two possible options: k withdrawals and k loans. Conventional wisdom advises against withdrawing funds from your k early. However, borrowing. Remember, though, the money you withdraw will no longer be there for you at retirement. If your (k) is the only funding source you have, then you might. Buying a home can be a huge financial undertaking, often requiring years of planning and saving, using a (k) retirement plan to buy a home is possible. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Some employers allow (k) loans only in cases of financial hardship, but you may be able to borrow money to buy a car, to improve your home, or to use for.

1 2 3 4 5 6