kagney-linn-karter.ru

Gainers & Losers

What Is Insurance Like On A Tesla

)

With Tesla being a premium electric vehicle manufacturer, insuring one may cost even more than the same coverage for a more affordable option, like an electric. This program leverages Tesla's cutting-edge vehicle technology to monitor driving behavior in real-time. By analyzing this data, Tesla Insurance can tailor. Tesla insurance comes in two types: a company-backed option sold by the automaker itself and third-party coverage options offered by leading auto insurers. Auto insurance for a Tesla Model Y costs about $ per year. See how these car insurance premiums vary by age, state, credit score and driving record. We have looked into several different options and Tesla has the lowest rates by far and even better coverage than we have on our current car. Types of Tesla auto insurance coverage options · Liability insurance: Pays for the medical expenses and lost wages of other parties if they get injured in a car. Tesla Model 3 insurance costs an average of $ per year or $ monthly for models, with low rates offered by Travelers, Auto-Owners and USAA. InsureMyTesla offers three fully comprehensive insurance policies – with various options such as battery protection, charging equipment coverage & glass cover. Tesla Insurance offers full coverage options with various limits and deductibles that can be tailored to your needs. With Tesla being a premium electric vehicle manufacturer, insuring one may cost even more than the same coverage for a more affordable option, like an electric. This program leverages Tesla's cutting-edge vehicle technology to monitor driving behavior in real-time. By analyzing this data, Tesla Insurance can tailor. Tesla insurance comes in two types: a company-backed option sold by the automaker itself and third-party coverage options offered by leading auto insurers. Auto insurance for a Tesla Model Y costs about $ per year. See how these car insurance premiums vary by age, state, credit score and driving record. We have looked into several different options and Tesla has the lowest rates by far and even better coverage than we have on our current car. Types of Tesla auto insurance coverage options · Liability insurance: Pays for the medical expenses and lost wages of other parties if they get injured in a car. Tesla Model 3 insurance costs an average of $ per year or $ monthly for models, with low rates offered by Travelers, Auto-Owners and USAA. InsureMyTesla offers three fully comprehensive insurance policies – with various options such as battery protection, charging equipment coverage & glass cover. Tesla Insurance offers full coverage options with various limits and deductibles that can be tailored to your needs.

Insuring a Tesla works the same way it does for any other vehicle, but these electric vehicles are expensive to insure. According to the National Association of. Compare the cost of insuring a Tesla vehicle, with rates starting at $87 per month. Carrying limits above the value of your Tesla will cost you less than going cheap. – The insurance cost per thousand is lowered at the higher end of coverage. Tesla Insurance uses Real-Time Insurance to calculate your monthly premium. See how safe driving can lower your monthly insurance premiums. We base your premium on how you drive. We use existing technology in our vehicles to track your real-time driving behavior, no additional hardware required. We base your premium on how you drive. We use existing technology in our vehicles to track your real-time driving behavior, no additional hardware required. The average price to insure a Tesla is about $2, a year according to some surveys. However, that number can vary significantly based on where you live, your. To save money on car insurance, consider purchasing the more affordable Tesla Model 3 and choosing Allied or Nationwide which offer the lowest average insurance. Car insurance on a Tesla can cost more than $ per month for full coverage, which is significantly more than the cost of similar coverage for other vehicles. Instead of traditional car insurance rating factors, like driving and claims history, Tesla uses real-time driving behavior to calculate monthly premiums. Its. AS far as how much it cost to insure a Tesla, there are too many factors that go into getting a quote so there is really no answer for that, but. Our rate analysis shows that average Tesla car insurance costs are higher, with average full coverage premiums ranging from 69 percent to percent higher. No. You do not need to purchase a Tesla Insurance policy if you have insurance from any other carrier to cover the Tesla vehicle. You will need insurance. The national average cost of car insurance is $2, per year for full coverage, which is about $ per month. To understand what your rate might be, it's. The average cost of car insurance for Tesla model S is $2, per year or $ per month in general, or $2, per year and $ per month with Tesla's auto. Tesla can only insure Tesla vehicles, so they cannot offer multicar discounts to other makes, there is no Auto/home discount, or other discounts. But Teslas are expensive to insure, with some models falling into the highest insurance category, Group 50, so it pays to compare quotes from a number of. Insuring a Tesla works the same way it does for any other vehicle, but these electric vehicles are expensive to insure. According to the National Association of. has been around a block or two, but that doesn't mean it can't keep up with newer models. The average Tesla Model S insurance is $ per month if you want full. Whereas the average annual insurance cost for a Tesla is anywhere between $1, and $4, While your usual car insurance will cover the usual risks your.

Under 18 Trading

Minors themselves cannot directly trade or own a trading account, but a parent or legal guardian can open a minor's trading account on their behalf. The. If you work in a shop, you cannot sell alcohol if you are under Trading Standards - selling alcohol · Citizens Advice - young people health and. Can teens invest in the stock market? You usually need to be at least 18 years old to participate in the stock market. However, there are some ways around that. Learn about the risks and potential rewards of exchange-traded funds, also known as ETFs. April 18, Technical Analysis Trading. What to Watch as You. Under the American Recovery and Reinvestment Act of 18 Prohibition on Contracting with Entities that Require Certain Internal. If the suggested limit is exceeded, we reserve the right to restrict additional deposits and trading capabilities. Must be under the age of 18 and must have. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. As a custodial account, the parent that opens the account manages the assets until the child reaches 18 (21 in some states). child about how the stock market. Brokerage and Trading · Brokerage and Trading Account · Types of Brokerage For a child under the age of 19 considered a dependent at the end of year. Minors themselves cannot directly trade or own a trading account, but a parent or legal guardian can open a minor's trading account on their behalf. The. If you work in a shop, you cannot sell alcohol if you are under Trading Standards - selling alcohol · Citizens Advice - young people health and. Can teens invest in the stock market? You usually need to be at least 18 years old to participate in the stock market. However, there are some ways around that. Learn about the risks and potential rewards of exchange-traded funds, also known as ETFs. April 18, Technical Analysis Trading. What to Watch as You. Under the American Recovery and Reinvestment Act of 18 Prohibition on Contracting with Entities that Require Certain Internal. If the suggested limit is exceeded, we reserve the right to restrict additional deposits and trading capabilities. Must be under the age of 18 and must have. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. As a custodial account, the parent that opens the account manages the assets until the child reaches 18 (21 in some states). child about how the stock market. Brokerage and Trading · Brokerage and Trading Account · Types of Brokerage For a child under the age of 19 considered a dependent at the end of year.

Yes, you can open an account for a person under the age of A Superhero minor account allows you to invest for your children. Trump Media stock slides under $18, a new low since it began publicly trading. Published Tue, Sep 3 PM EDT Updated Tue, Sep 3 PM EDT. A stock price might sink so low that a company's reputation can be put at risk. Other times, a price that dips below a certain threshold can cause the stock to. Since these planned trades are set up in advance of subsequent trading Alternative Basis of Criminal Liability: Securities and Commodities Fraud under 18 USC. Paper trade till your 18, or ask your parents to make you an account w like bucks and trade that till your If you have multiple Cash App accounts, and/or multiple sponsored accounts, they are included under the same insurance coverage. Bitcoin trading is offered by. 18 fraud statutes, such as 18 USC ) In Dirks, the Supreme trading have usually been under $, Philippines. edit. Under. investing or personal finance course. How to start saving as a teen (or younger, or older for that matter). A minor —under the age of 18 or 19, depending on. Yes, minors can have a Demat account but not a Trading account. Please reach out to any of our branches to open your account offline as an account for minors. With effect from 1 March , the age of contractual capacity under the Civil Law Act has been lowered from 21 to In relation to a Trading Member. It is illegal for you to pretend that you are 18 when you are not. If you do, indeed, make a lot of money trading long positions, there is nothing in the law. yes, you can but you are not allowed to open an account under you have to open account using your family member who is 18+. first, try to. Note that we can't add any stocks trading below $3, penny stocks, bulletin board If you are under 18, you will need to open your account with an adult. Once the beneficiary has turned 18, these shares can be transferred out of the Minor Trust Account and into an account in the beneficiary's own name using an. And if you're opening it for someone under 18, you need to make it a "custodial" account. One thing to keep in mind, if you're moving any assets from. Generally speaking, people under the age of 18 don't have the same full contracting power that adults do. However, where minors enter into contracts the tax. What's New. Version History. Sep 4, Version Here's what's under the hood in our latest update: Webull: Investing & Trading. Finance. Contribute up to 18% of last year's income or a max of $31, Reduces your How does Wealthsimple have $0 commission on trading stocks & ETFs when other. Yes, you can open an account for a person under the age of A Superhero minor account allows you to invest for your children. by, or are under common control with, those of the issuer. Affiliates 30 minutes before the close of trading in the market where the purchase is made.

Pros And Cons Of Refinancing Mortgage With Cash Out

Check out the current mortgage interest rates. Are they lower than the rate you're paying for your present mortgage? A cash-out refinance would allow you to not. The opportunity for snagging a lower rate is the most popular reason for refinancing a home loan. For cash-strapped homeowners, a smaller payment each month. The benefits of refinancing your mortgage · a lower interest rate (APR) · a lower monthly payment · a shorter payoff term · eliminate private mortgage insurance . A cash-out refinance may attract a higher interest rate compared to a traditional mortgage because of extra risk to the Lender. Cash-out refinance loans have. You should always consider the applicability of loan products to your individual needs. In addition to the pros of a Cash-Out Refi, you should also consider. Cash out refinances increase the principal balance of your mortgage. They Learn the Pros and Cons of Cash Out Refinancing. Cash Out Refinance Credit. Cash Out Refinancing Pros and Cons. In one corner, you have potentially lower interest rates. In the other corner, you have the potential risk of foreclosure. Pros · Get the cash you need without resetting your existing mortgage term and interest rate · Lower closing costs and fees, in most cases, compared to a mortgage. Mortgage Cash Out Re-Fi · Lower Interest Rates. Your interest rate will only be lower if you bought your home at a time when rates were high. · Consolidating Debt. Check out the current mortgage interest rates. Are they lower than the rate you're paying for your present mortgage? A cash-out refinance would allow you to not. The opportunity for snagging a lower rate is the most popular reason for refinancing a home loan. For cash-strapped homeowners, a smaller payment each month. The benefits of refinancing your mortgage · a lower interest rate (APR) · a lower monthly payment · a shorter payoff term · eliminate private mortgage insurance . A cash-out refinance may attract a higher interest rate compared to a traditional mortgage because of extra risk to the Lender. Cash-out refinance loans have. You should always consider the applicability of loan products to your individual needs. In addition to the pros of a Cash-Out Refi, you should also consider. Cash out refinances increase the principal balance of your mortgage. They Learn the Pros and Cons of Cash Out Refinancing. Cash Out Refinance Credit. Cash Out Refinancing Pros and Cons. In one corner, you have potentially lower interest rates. In the other corner, you have the potential risk of foreclosure. Pros · Get the cash you need without resetting your existing mortgage term and interest rate · Lower closing costs and fees, in most cases, compared to a mortgage. Mortgage Cash Out Re-Fi · Lower Interest Rates. Your interest rate will only be lower if you bought your home at a time when rates were high. · Consolidating Debt.

* A Cash out refinance replaces the riskier high rates on Credit Cards, with a lower stablized rates associated with a Mortgage. The benefit -. Refinancing at a time when rates are low, not only switches your loan to a shorter term, but can help you save money on interest. Plus, paying off your loan. 5 Benefits of a Cash-Out Refi · 1. You can use the cash you get for major expenses. It's in the name. · 2. You may be able to consolidate your debt. · 3. You may. You can opt for a cash-out refinance as long as you have at least 20% equity in your home. You'll also have to qualify for this program. Lenders will look at. Getting a cash-out in a mortgage refinance can help homeowners obtain large, lump sum cash payments; however, refinancing may not be the best choice for. On the plus side, you'll usually receive a lower interest rate when you apply for a cash-out refinance. That can result in lower monthly payments. On the. * A Cash out refinance replaces the riskier high rates on Credit Cards, with a lower stablized rates associated with a Mortgage. The benefit -. What Are the Cons of a Cash Out Refinance? A cash out refinance will increase the amount of money you owe on your mortgage. It can increase the amount of your. If you need money for an unexpected expense or to help pay off debt, you may consider taking out a loan. But if you own a home, a cash-out refinance may. Cons of Cash-Out Refinancing · A Bigger Loan: If your home has increased in value and you are cashing out a significant amount of equity, then your refinanced. A cash-out refinance allows you to replace your current mortgage and access a lump sum of cash at the same time. 1 Lower monthly payments · 2 Lower interest rate · 3 Switch to a fixed rate · 4 Reduce your loan term · 5 Cash-out refinance. Check out the current mortgage interest rates. Are they lower than the rate you're paying for your present mortgage? A cash-out refinance would allow you to not. A cash-out refi is a good idea if you want a lower interest rate, different home loan type, or if you want to pay off your loan amount faster. One of the most. Cons · You'll lose at least some of your home equity. A cash-out refinance will generally reduce or eliminate the home equity you've built over time. · You may. Pros · Get the cash you need without resetting your existing mortgage term and interest rate · Lower closing costs and fees, in most cases, compared to a mortgage. Tax benefits: Because the money you receive from a cash-out refinance is considered a loan rather than income, you don't need to pay taxes on the funds you. Cons · You'll lose at least some of your home equity. A cash-out refinance will generally reduce or eliminate the home equity you've built over time. · You may. Pros and Cons The primary advantage of a cash-out refinance is that the borrower can realize some of their property's value in cash. With a standard refinance. Cash-out Refinance Pros & Cons · If you purchased your home when mortgage rates were high, a cash-out refinance could give you a lower interest rate. · If you use.

How To Get Money With Stocks

No matter your income, you will get rich off stocks as long as you start investing early, keep investing, and never sell. Usually known as 'capital growth' or 'capital gain', all this means is that you make money by buying your shares for one price and selling them for a higher. William J. O'Neil's national bestseller, How to Make Money in Stocks, has shown over 2 million investors the secrets to building wealth. To succeed in making money with stock trading, you'll need to do something different — create a long-term strategy. There are two ways you could make money from investing. One is if the shares increase in value, meaning you reap a profit when you sell them. The other is if. In this article, we'll explore how to make money in the stock market and deal with its ups and downs. These insights will be helpful whether you're a beginner. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. You can cash out of your stocks in four steps: Order to sell shares – You need to log on to your brokerage account and choose the stock holding that you would. These profits are known as capital gains. In contrast, if you sell your stock for a lower price than you paid to buy it, you'll incur a capital loss. In. No matter your income, you will get rich off stocks as long as you start investing early, keep investing, and never sell. Usually known as 'capital growth' or 'capital gain', all this means is that you make money by buying your shares for one price and selling them for a higher. William J. O'Neil's national bestseller, How to Make Money in Stocks, has shown over 2 million investors the secrets to building wealth. To succeed in making money with stock trading, you'll need to do something different — create a long-term strategy. There are two ways you could make money from investing. One is if the shares increase in value, meaning you reap a profit when you sell them. The other is if. In this article, we'll explore how to make money in the stock market and deal with its ups and downs. These insights will be helpful whether you're a beginner. To trade stocks, you need to set clear investment goals, determine how much you can invest, decide how much risk you can tolerate, pick an account at a broker. You can cash out of your stocks in four steps: Order to sell shares – You need to log on to your brokerage account and choose the stock holding that you would. These profits are known as capital gains. In contrast, if you sell your stock for a lower price than you paid to buy it, you'll incur a capital loss. In.

In this article, we'll explore how to make money in the stock market and deal with its ups and downs. These insights will be helpful whether you're a beginner. Direct stock plans. Some companies allow you to buy or sell their stock directly through them without using a broker. This saves on commissions, but you may. Using investing apps like Robinhood and Webull is a good first step. Both brokerages offer commission-free trading on stocks, options, ETFs and crypto, with no. Stocks carry some of the best potential for long-term returns. Since Nasdaq's inception in , stocks have returned more than 10 percent annually, on average. The two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock. Our guides can help you choose an investment fund, or teach you how to buy shares if you'd prefer to go down the DIY route. Plus, find out how a stocks and. Where to Start Investing in Stocks The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. Investors can cash out stocks by selling them on a stock exchange through a broker. Stocks are relatively liquid assets, meaning they can be converted into. Yes, very easy. Just buy a stock at lower price and sell it at higher price. Buy at 10, sell at Boom, 10% profit. Use leverage and boom %. Currently, you can choose Cash, Interest or Stocks. If you choose to hold your money as Stocks, we'll invest all of the balance or Jar in a fund we've chosen. The reason to buy shares in a company is so you can profit from that company's performance. There are two ways your shares can make you money. Capital gains are. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Here's a step-by-step guide to investing money in the stock market to help ensure you're doing it the right way. William J. O'Neil's national bestseller, How to MakeMoney in Stocks, has shown over 2 million investors the secrets to building wealth. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. The bestselling guide to buying stocks, from the founder of Investor's Business Daily now completely revised and updated. High-yield bonds have been one of the best-performing bond investments so Investing Basics: Stocks. Stocks are one of the most common investments. While you can make short-term profits in the stock market, it's actually a safer bet to leave your money in the market for the long term and let compound. Set your budget – Try to create a realistic budget before you invest in stocks. Consider using your after-tax income as a measure so you know exactly how much.

Does Cancelling A Credit Card Lower Your Credit Score

Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your credit score. The answer is yes, cancelling a credit card randomly can negatively impact your credit score. This is especially true when your account is mature or has been. Your score is based on the average age of all your accounts, so closing the one that's been open the longest could lower your score the most. Closing a new. Canceling your oldest form of credit may negatively impact your credit score. Depending on your situation, you may be better off downgrading your card or using. Your score is based on the average age of all your accounts, so closing the one that's been open the longest could lower your score the most. Closing a new. Closing a credit card can negatively impact your credit utilization ratio, which is the second most important factor in determining your FICO credit score. The. However, closing your cards will not only lower your utilization, but it also removes credit history, which damages your score in the length of history category. Yes, closing a credit card does hurt your credit score in the short term, depending on how old the accounts are and how much other credit you have. But. It's never recommended to close a credit card account for the sole purpose of raising your score. Find out why and what to do instead. Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your credit score. The answer is yes, cancelling a credit card randomly can negatively impact your credit score. This is especially true when your account is mature or has been. Your score is based on the average age of all your accounts, so closing the one that's been open the longest could lower your score the most. Closing a new. Canceling your oldest form of credit may negatively impact your credit score. Depending on your situation, you may be better off downgrading your card or using. Your score is based on the average age of all your accounts, so closing the one that's been open the longest could lower your score the most. Closing a new. Closing a credit card can negatively impact your credit utilization ratio, which is the second most important factor in determining your FICO credit score. The. However, closing your cards will not only lower your utilization, but it also removes credit history, which damages your score in the length of history category. Yes, closing a credit card does hurt your credit score in the short term, depending on how old the accounts are and how much other credit you have. But. It's never recommended to close a credit card account for the sole purpose of raising your score. Find out why and what to do instead.

Closing a credit card does have the potential to impact your credit score. Credit reporting companies such as Experian, Equifax and Illion keep a record of. Although secured cards typically have low credit limits, closing one will still decrease the amount of credit you have available. This will cause your credit. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which. Cancelling a credit card does not ruin your credit. It does not lower your credit score due to age. Again, cancelling a card does not ruin your credit or lower. Cancelling a credit card does not ruin your credit. It does not lower your credit score due to age. Again, cancelling a card does not ruin your credit or lower. Your application will trigger a hard inquiry which causes your score to dip slightly. And, if approved, a new line of credit will reduce the overall age of your. Random closing of credit card accounts — without careful planning — almost certainly will lower your credit score because you are reducing your available. Know how it will affect your credit. Unfortunately, closing a card will never help your score, and only has the ability to hurt it. Take a look at some aspects. Canceling a credit card can increase your credit utilization because you're losing a line of credit. If your total available credit goes down, but the amount of. Closing a credit card can impact your credit utilization ratio, potentially dinging your credit score. Credit utilization measures how much of. So, cancelling a credit card may impact your score, but it really depends on the lender. One reason your score may be negatively affected is that your overall. Closing credit cards does reduce your credit score. Doing this at the wrong Whenever you make a major purchase that requires a loan, the lender will check. If you are constantly applying for credit cards, this can add up to a lot of hard inquiries on your credit report, thus lowering your credit score, even if just. 2. It may not affect your credit score: Closing a credit card with a short history may be less impactful to your credit score than closing a credit card you'. The short answer is that closing credit cards will probably lower your score, at least in the short term. If you have debt on other accounts, losing the available credit can reduce your debt-to-available-credit ratio, which can affect your credit score. Enhanced. Your credit utilization ratio may increase. Closed credit card accounts can negatively impact your credit score for several reasons. When an account is canceled. Closing a credit card can affect the length of your credit history. That's important because credit history is one of the factors used to help determine your. Yes, closing a credit card does hurt your credit score in the short term, depending on how old the accounts are and how much other credit you have.

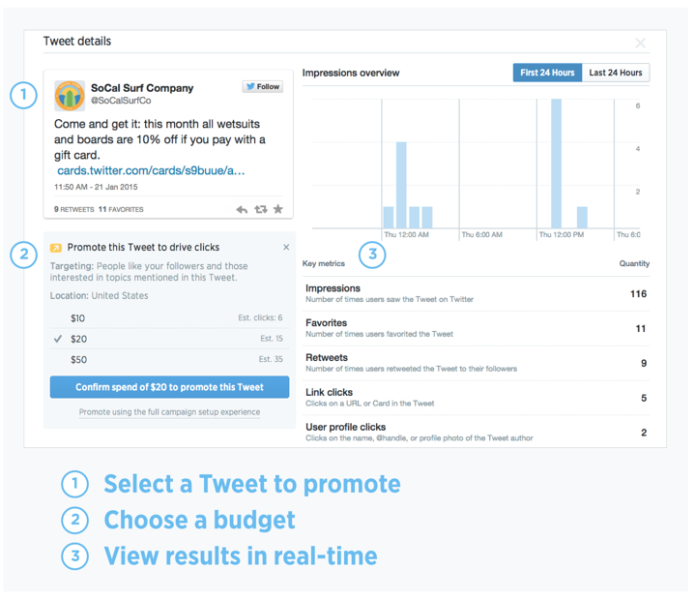

How Do I Promote A Tweet

You can easily (and pretty cheaply) engage your followers with a Twitter poll. This will create conversation and will generate likes, replies, and retweets. You can build a large, targeted following on Twitter. It's simple, effective, and best of all, only takes a few minutes of your day. How to Promote Your Tweets · Getting started with Twitter · Choose an objective · Set up targeting · Set a budget · Create your Tweets · Quick promote your. Here are three things you can do with Twitter ads that can help your company benefit in different ways, depending on your social media advertising goals. Twitter Ads allow companies and users to promote tweets, accounts, and trends with the objective of increasing traffic, gaining relevance, or branding. To give your content and Twitter account an added boost, Twitter Advertising is a great product. Here's how to use Promoted Tweets, Accounts and Trend. Click on Promote your tweet. Select your country and time zone, provide your contact information, and agree to the Twitter Advertising Terms. I paid $50 to promote it over two days, and was told it needed to be verified before the promotion would begin, which already annoyed me as I mentioned. Select 'Advertise' on the Twitter main page and select country. Compose a tweet and click the 'tweet' button. Select demographic, run time and. You can easily (and pretty cheaply) engage your followers with a Twitter poll. This will create conversation and will generate likes, replies, and retweets. You can build a large, targeted following on Twitter. It's simple, effective, and best of all, only takes a few minutes of your day. How to Promote Your Tweets · Getting started with Twitter · Choose an objective · Set up targeting · Set a budget · Create your Tweets · Quick promote your. Here are three things you can do with Twitter ads that can help your company benefit in different ways, depending on your social media advertising goals. Twitter Ads allow companies and users to promote tweets, accounts, and trends with the objective of increasing traffic, gaining relevance, or branding. To give your content and Twitter account an added boost, Twitter Advertising is a great product. Here's how to use Promoted Tweets, Accounts and Trend. Click on Promote your tweet. Select your country and time zone, provide your contact information, and agree to the Twitter Advertising Terms. I paid $50 to promote it over two days, and was told it needed to be verified before the promotion would begin, which already annoyed me as I mentioned. Select 'Advertise' on the Twitter main page and select country. Compose a tweet and click the 'tweet' button. Select demographic, run time and.

We'll walk you through everything you need to know to get started on X, including setting up your account, using the platform, and promoting your business for. The Twitter promotion mode is a monthly membership and effectively gives the power to the social media platform to boost your content. Usually, the first ten. If you'd only like to promote existing organic Tweets, no further action is needed. Skip to page 7. To include Promoted-only Tweets in your campaign, continue. Only your first 10 tweets a day can become promoted tweets as long as these tweets are approved by Twitter and comply with their Twitter advertising policy. In this article, you'll learn how to promote tweets, the cost and how to delete one. You'll also see how to identify promoted tweets on your timeline. Twitter is actually perfect for promoting blog posts because blog posts are samples of your writing that are short, digestible, and available with the click of. For as long as your subscription runs, Twitter Promote Mode will act as an 'always-on' service, promoting your first 10 tweets of the day. Your retweets, quote. Promoting a tweet is paid a service that is done through Twitter Ads. Promoting a tweet will make the selected tweet appear to everyone under the selected. We've compiled a list of 21 different ways you can use Twitter to promote your next event. Promotional needs vary from event to event, venue to venue, and. Promoting a tweet may cost fairly less considering the other two options. This would cost approximately $ -$2 per engagement while promoting an account would. How To Boost a Promoted Tweet: 4 Steps for Using Ads on X · 1. Open a Twitter or X Ads Account · 2. Indicate Your Ad Campaign's Goal · 3. Determine Your Target. If you'd only like to promote existing organic Tweets, no further action is needed. Skip to page 7. To include Promoted-only Tweets in your campaign, continue. This article will guide you through several methods to boost your Twitter reach. From search engine optimization of your tweets to leveraging Owlead for a. We'll walk you through everything you need to know to get started on X, including setting up your account, using the platform, and promoting your business for. The promoted tweet can be defined as the ordinary tweet purchased by marketers to promote their products on larger audiences. Promoted tweets can typically. Promoted Tweets (aka Sponsored Tweets), are standard Tweets, except they're paid for by advertisers attempting to increase their Twitter reach and/or engagement. To create a sponsored tweet, you first need to create an ad campaign on Twitter. Once you've done this, you can then create your tweet and choose to promote it. You can link anyone from a tweet to wherever you're running your giveaway. Unlike a Facebook status update, you'll need to pick and choose what you say. The Twitter promotion mode is a monthly membership and effectively gives the power to the social media platform to boost your content. Usually, the first ten. Instead of paying Twitter to promote your tweets, you can help yourself by using various strategies to promote your Twitter for free.

Does Apple Card Improve Credit Score

This card is amazing. I've used it for almost everything Apple related. I currently finance my watch and my girlfriends watch through the card and I also get 3%. We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. Card usage and payment history may impact each co-owner's credit score differently because each individual's credit history will include information that is. This score improvement resource does not guarantee you will reach your credit score Chase credit cards can help you buy the things you need. Many of. Credit Builder offers features that help you stay on top of key factors that impact your credit scores. Consistent use of Credit Builder can help you build. However, the inquiry will fall off your credit reports in two years — and once the loan funds have been used to pay off all or most of your credit card balance. Healthy finances. Family style. · Co‑Owners manage the account together and build credit as equals. · Participants age 18 and over can build their own credit. Credit impact: If you're new to credit or rebuilding your credit score, having a loved one add you as an authorized user on their credit card can have an. Does Apple's card negatively affect credit scores? Apple cards don't negatively affect your credit score until you make timely payments. The company also. This card is amazing. I've used it for almost everything Apple related. I currently finance my watch and my girlfriends watch through the card and I also get 3%. We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. Card usage and payment history may impact each co-owner's credit score differently because each individual's credit history will include information that is. This score improvement resource does not guarantee you will reach your credit score Chase credit cards can help you buy the things you need. Many of. Credit Builder offers features that help you stay on top of key factors that impact your credit scores. Consistent use of Credit Builder can help you build. However, the inquiry will fall off your credit reports in two years — and once the loan funds have been used to pay off all or most of your credit card balance. Healthy finances. Family style. · Co‑Owners manage the account together and build credit as equals. · Participants age 18 and over can build their own credit. Credit impact: If you're new to credit or rebuilding your credit score, having a loved one add you as an authorized user on their credit card can have an. Does Apple's card negatively affect credit scores? Apple cards don't negatively affect your credit score until you make timely payments. The company also.

If you use the physical card, you'll earn 1% cash back on purchases, and there are many other cards that offer higher rewards. You can share your Apple Card. Extra members who use the product as recommended were more likely to achieve and maintain good credit scores than consumers who demonstrated healthy credit. We report to the major bureaus so you can grow your credit score with responsible credit use. iPhone. Pay from your phone. Add your Petal card to your mobile. Help build your credit · A minimum security deposit of $ (maximum of $5,) is required to open this account. · FICO® Score · Deposit · Learn more about credit. The monthly credit review required for the program doesn't negatively impact your credit score. How to finish your personalized steps. If your Apple Card. How does applying for the card impact my credit score? Completing the application will not impact your credit score but all account openings and payment. Apple Card reports to multiple credit bureaus. To benefit from 2% Cash Back rewards, customers will need to be able to use Apple Pay. Although acceptance is. Healthy finances. Family style. · Co‑Owners manage the account together and build credit as equals. · Participants age 18 and over can build their own credit. card responsibly and over time it can improve your overall credit score. The PNC Secured Visa credit card can only be opened in person at a PNC Bank Branch. applicants in improving their credit, with the goal of obtaining an Apple Card upon completion can reduce the person's credit score at least temporarily. They share full responsibility for the account balance and all payments, even if one account co-owner does not pay. · They can build credit together equally. It is much more than a good credit score. You should read all of the info before applying for the card. Once you submit an application the. Apple says that if your FICO9 score is lower than , Goldman Sachs might not be able to approve you. The Apple Wallet app. Everything you'll need to do with. With Savings, you can choose to send your Daily Cash to a high-yield Savings account where it can earn % annual percentage yield (APY). Yes and no. To get the best credit score, you want to make sure that the card company reports a utilization of less than 30%. Better is. In , Apple and Goldman Sachs partnered to launch Apple Card. It works primarily via Apple Pay, though a physical card is also available. At this time, only some Affirm loan types are eligible to be reported to Experian. These things won't affect your credit score: Creating an Affirm account. PREMIER Bankcard® Grey Credit Card · Pre-qualify with no impact to your credit score · Helping people build credit is our first priority – start your credit-. Participants do not build credit so probably not - Apple Card - Family - Apple! score around , I have friends who only have credit for like 3 months. With the Apple Credit Card, you can earn cash-back rewards for every purchase. And the best part? You get 3% cash back on purchases made from Apple, 2% on.

Ipo Date Meaning

From the first day of the IPO, some companies' shares enter a phase that typically lasts three days. This is known as 'conditional trading'. During this stage. The process of offering an IPO is long and involves hiring an investment bank as advisors who set prices and dates, market the company, and handle finances. In an IPO, a privately owned company lists its shares on a stock exchange, making them available for purchase by the general public. Used in the context of bonds to refer to the date on which a bond is issued and when interest beings to accrue to the bondholder. Used in the context of stocks. Just to initiate you, it is an abbreviation of initial public offering. When you read that a company is launching an IPO, it means that a private business has. An IPO (initial public offering) is the first time a business raises finance publicly. Before that, it can only use private investment. Going public allows your. An initial public offering (IPO) is listing and selling new, publicly tradeable, shares to investors that receive an allotment from an underwriter or. An initial public offering, or IPO, generally refers to when a company first sells its shares to the public. For more information about IPOs generally. The IPO Process is where a private company issues new and/or existing securities to the public for the first time. The 5 steps discussed in detail. From the first day of the IPO, some companies' shares enter a phase that typically lasts three days. This is known as 'conditional trading'. During this stage. The process of offering an IPO is long and involves hiring an investment bank as advisors who set prices and dates, market the company, and handle finances. In an IPO, a privately owned company lists its shares on a stock exchange, making them available for purchase by the general public. Used in the context of bonds to refer to the date on which a bond is issued and when interest beings to accrue to the bondholder. Used in the context of stocks. Just to initiate you, it is an abbreviation of initial public offering. When you read that a company is launching an IPO, it means that a private business has. An IPO (initial public offering) is the first time a business raises finance publicly. Before that, it can only use private investment. Going public allows your. An initial public offering (IPO) is listing and selling new, publicly tradeable, shares to investors that receive an allotment from an underwriter or. An initial public offering, or IPO, generally refers to when a company first sells its shares to the public. For more information about IPOs generally. The IPO Process is where a private company issues new and/or existing securities to the public for the first time. The 5 steps discussed in detail.

effective, which means the company may proceed to consummate its IPO. Although the staff will not declare a registration statement effective if the staff. IPOs date back to , when the largest commercial enterprise in the world back then, the Dutch East India Company, invited the general public to buy shares of. An IPO pop happens when a newly public company's stock increases in value when it debuts on the market. In , some of the biggest IPO pops were Doordash . After an initial block of shares is sold, the company and its underwriters set an initial public price and a date for the stock to begin trading on a public. An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to. Once the IPO has been approved by the exchange and an IPO date has been set, the company and underwriter will decide on the offer price and the number of. The first modern IPO took place on the Amsterdam Stock Exchange in March , when the Dutch East India Company sold shares of the company to the public. IPO Filing Date means the date on which the Form S registration statement relating to the IPO is first filed with the Securities and Exchange Commission. Participating in an initial public offering (IPO) provides an opportunity to invest in a newly public company's stock. As you think about requesting to. IPO Date means the date of the underwriting agreement between the Company and the underwriter(s) managing the initial public offering of the Ordinary Shares. An IPO is a private company's first offering of new stock to the investing public. Learn how an IPO process works, how to find the latest IPOs online. This date varies depending on the company but is when investors receive the credited IPO shares in their Demat accounts. This happens before the official. What is an IPO? An Initial Public Offering, or IPO, is when a private company becomes a public company by offering shares on a securities exchange such as the. IPO Meaning/Definition IPO means Initial Public Offering. It is a process by which a privately held company becomes a publicly-traded company by offering its. Reach preliminary decisions regarding the number, price, and date of issue of company shares. Market the public offering to potential investors. File with the. Definition: Initial public offering is the process by which a private company can go public by sale of its stocks to general public. It could be a new. date on which the issuer conducts a roadshow (as defined in. Securities Act Rule ). This day period (sometimes referred to as a seasoning period) is. The act of having an IPO is sometimes referred to as "going public," as it enables the general public to participate in trading shares in a specific company. IPO ·. Means the Company's first underwritten public offering of its Common Stock under the Securities Act. ·. Has the meaning set forth in the Recitals. ·. ·.

What Is An Executive Mba Degree

An executive MBA and an MBA are both high-level qualifications in business management. The main difference is the learning environment: MBA programs are geared. A part-time master's program could take a working professional several years to complete, depending on how many classes are taken per semester. Most executive. EMBA, short for Executive Master of Business Administration, is also a general management qualification. However, EMBA programs are typically done part-time. At Chicago Booth, we offer one MBA degree with the same world-class faculty, the same rigorous courses, and the same powerful, global network. There are some. A part-time, two-year MBA for fully employed senior managers that broadens knowledge of various components of business leadership. Like a traditional MBA degree program, the EMBA's core curriculum revolves around foundational business classes like finance, statistics, management and. An executive MBA, also known as an EMBA program, is a graduate business degree for experienced professionals. Like a traditional MBA, the EMBA Program teaches. The Executive MBA track is taught at the UCF Downtown campus each fall. Students with a bachelor's degree from a regionally accredited institution with a. Get the most out of your career. The ASU Executive MBA is designed for senior leaders with increasing responsibility managing people, projects, and budgets. An executive MBA and an MBA are both high-level qualifications in business management. The main difference is the learning environment: MBA programs are geared. A part-time master's program could take a working professional several years to complete, depending on how many classes are taken per semester. Most executive. EMBA, short for Executive Master of Business Administration, is also a general management qualification. However, EMBA programs are typically done part-time. At Chicago Booth, we offer one MBA degree with the same world-class faculty, the same rigorous courses, and the same powerful, global network. There are some. A part-time, two-year MBA for fully employed senior managers that broadens knowledge of various components of business leadership. Like a traditional MBA degree program, the EMBA's core curriculum revolves around foundational business classes like finance, statistics, management and. An executive MBA, also known as an EMBA program, is a graduate business degree for experienced professionals. Like a traditional MBA, the EMBA Program teaches. The Executive MBA track is taught at the UCF Downtown campus each fall. Students with a bachelor's degree from a regionally accredited institution with a. Get the most out of your career. The ASU Executive MBA is designed for senior leaders with increasing responsibility managing people, projects, and budgets.

Designed for seasoned executives, the month Executive MBA program offers an industry-focused learning experience dedicated to developing personal. The Executive MBA (EMBA) Program. The The EMBA is a cohort-style team-based program tailored for driven professionals seeking to earn their MBA in an. The MIT Executive MBA is a rigorous month executive-schedule MBA program designed for mid-career executives poised at pivotal junctures in their careers. Our Executive MBA (EMBA) is a rigorous, weekend program that builds on the base of your managerial experience to help you advance to the highest levels of. An executive MBA program referred to as an EMBA enables executives to earn the degree while continuing to hold their existing jobs. The online Executive Master of Business Administration (eMBA) Program is a two year program uniquely designed to meet the challenging needs of mid-career. The 'E' in EMBA stands for executive—but that doesn't necessarily mean EMBAs are superior to MBAs. They're essentially the same degree, but EMBAs are structured. The Professional MBA (PMBA): A Flexible Curriculum for Working Professionals. A professional MBA program—or PMBA—is a business graduate degree built to. What Personal Development Opportunities does an Executive MBA Program Offer? The structure of the programs is mostly focused on developing the relevant skills. If you are a mid-career professional looking for a track into the C-suite, an executive MBA program provides you with a robust network of highly-motivated. Executive MBA students earn the same degree as full-time students, benefiting from the same high-level coursework with many of the same professors. Choose. Cornell's Samuel Curtis Johnson Graduate School of Management offers a trio of executive MBA programs, each built upon the rigor of an Ivy League education. MBAs in Top 50 Tech · Northwestern (Kellogg) · 71UPenn (Wharton) · 65INSEAD · 54Quantic · 51HEC Paris · 51NYU (Stern) · 50Columbia · 49Harvard. MBA students continue learning various business practices, from accounting and finance to marketing and project management. This advanced degree is suitable for. Executive MBA programs (EMBA) have existed since , yet people still wonder how this degree is different from a traditional MBA. The Executive MBA Program equips future leaders and entrepreneurs with a world-class curriculum focused on strategy and leadership development. The Executive MBA curriculum offers students a high-level perspective on data-driven decision-making, strategic management, leadership, and global business. Enrolling in Kellogg's Executive MBA (EMBA) Program is one of the best investments you can make in your future. Here in the company of the world's most. The Wharton Executive MBA Program is a top-ranked, flexible program designed for working professionals. Advance your career with our EMBA program today. Business leaders can earn an EMBA while still working full time. Courses often focus on leadership skills, teamwork and professional development.

Stainless Steel Pricing

Producer Price Index by Commodity: Metals and Metal Products: Steel Wire, Stainless Steel (WPU) ; Jul ; Jun ; May $/lb · Recent Price History · About Stainless Steel. The price of stainless steel is driven largely by the price and availability of the commodities that make up the grade. Stainless Steel Scrap Price Per Pound. As a leading stainless steel scrap buyer, Scrapworks offers competitive prices for stainless steel scrap per. Our market analysis draws on our multi-commodity capabilities across nickel, ferroalloys and steel to provide an in-depth examination of stainless steel flat. Stainless Steel Price Outlook. The price of Hot Rolled SS Coil (United States) increased during April to 2, USD per metric ton, which represents a. Subscribe for instant access to the latest World Stainless Steel Prices. Specific tables for markets that matter to your business. 3 years historical data. A long phase of general elections in the country this year majorly kept the stainless steel () market stable. The monthly average prices in the country went. Specific stainless steel prices per pound · series stainless steel: $ · stainless steel: $ · Stainless steel sinks: $ · stainless steel. Producer Price Index by Commodity: Metals and Metal Products: Steel Wire, Stainless Steel (WPU) ; Jul ; Jun ; May $/lb · Recent Price History · About Stainless Steel. The price of stainless steel is driven largely by the price and availability of the commodities that make up the grade. Stainless Steel Scrap Price Per Pound. As a leading stainless steel scrap buyer, Scrapworks offers competitive prices for stainless steel scrap per. Our market analysis draws on our multi-commodity capabilities across nickel, ferroalloys and steel to provide an in-depth examination of stainless steel flat. Stainless Steel Price Outlook. The price of Hot Rolled SS Coil (United States) increased during April to 2, USD per metric ton, which represents a. Subscribe for instant access to the latest World Stainless Steel Prices. Specific tables for markets that matter to your business. 3 years historical data. A long phase of general elections in the country this year majorly kept the stainless steel () market stable. The monthly average prices in the country went. Specific stainless steel prices per pound · series stainless steel: $ · stainless steel: $ · Stainless steel sinks: $ · stainless steel.

The latest recorded price for SS CR plate (6 mm) CFR Alabama Port stands at USD /MT, reflecting a persistently negative pricing environment. Overall. BusinessAnalytiq will decrease risk and higher profit. See pricing. businessanalytiq. Where does the data come from. Price. Add to Cart. SP 24 GA +/-) thick /L Stainless Steel Sheet - #4 Brush Polish. SP. 24 GA +/-) thick /L Stainless Steel Sheet. The latest quarter-ending price for Stainless Steel CR Coil in the USA was USD /MT for SS CR plate (6 mm) CFR Alabama Port. This price reflects the. Daily Nickel/Stainless Steel Briefing. Nickel closed Thursday's trading session at $/lb ($16,/tonne). Indicators at am CST today show nickel. Overall, the estimated price of stainless steel will be around $1, to $1, per ton in The total price for stainless steel is divided into three parts; the base Therefore, we decided to remove daily alloy surcharge option from our pricing, as. Producer Price Index by Commodity: Metals and Metal Products: Steel Pipe and Tube, Stainless Steel (WPU) ; Jul ; Jun ; May Refractories · Stainless HR Coil - /No.1 mm In warehouse China · Sign in to view · Sign in to view · % · % · % · % · %. Energy Costs: It takes a lot of energy to melt and shape stainless steel, just like it does for copper, aluminum, and steel. Because of this, the price of. The chart below summarizes Stainless steel price trend per region, as well as the outlook. It takes a moment to load. The latest, independently-researched North America stainless steel prices. month price, index & forecast subscriptions from MEPS, the steel pricing. North America Stainless Steel Prices in Tonnes (T) ; Jan, , , , ; Feb, , , , Stainless steel price August and outlook (see chart below) · Very recent price developments of immediate cost drivers of Stainless steel prices · Recent. Current Month Stainless Steel Price ; , Tuesday, , , Decrease in scrap price ; , Monday, , no change, No Change in scrap price. Steel is expected to trade at Yuan/MT by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. United States - Producer Price Index by Commodity: Metals and Metal Products: Steel Pipe and Tube, Stainless Steel was Index Dec = in July. 14ga ") Stainless Steel, Cold Rolled & Annealed, 2B Finish ; 12"x12" Plate · lbs · $ ; 12"x18" Plate · lbs · $ ; 12"x24" Plate · Links to more producers and distributors at bottom of page. All prices /lb. Allegheny Ludlum. AK Steel/. Cleveland Cliffs. Allegheny Distributor. The latest quarter-ending price stood at USD /MT for SS HR Plate (6 x x ) Ex Shanghai. The overall pricing environment has been negative.

2 3 4 5 6 7