kagney-linn-karter.ru

Community

How Much Financial Planners Charge

How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. Financial advisor fees are charges you pay for professional advice and management of your financial planning and investment portfolio. These fees can vary. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. As we've discussed in other blogs about the cost of financial advice, high fees are destructive to the long term creation of wealth. If you had a $1MM portfolio. For simple suggestions and general oversight, an advisor may charge between $1, to $2, A greater level of service will warrant higher fixed fees or a. Advisors who charge a 1% annual fee typically offer asset management. If you get additional services on top of investment management services, the fee might be. A basic overall retirement plan might cost anywhere from $ to $ Advice on how to allocate your (k) retirement account might range from $ to. How Much Does a Financial Advisor Cost? Most financial advisors charge a percentage of the assets that they manage for you. The average fee is a little over 1%. The cost of hiring a financial planner in Ontario, Canada, varies widely based on the fee structure, the services provided, and the planner's qualifications. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. Financial advisor fees are charges you pay for professional advice and management of your financial planning and investment portfolio. These fees can vary. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. As we've discussed in other blogs about the cost of financial advice, high fees are destructive to the long term creation of wealth. If you had a $1MM portfolio. For simple suggestions and general oversight, an advisor may charge between $1, to $2, A greater level of service will warrant higher fixed fees or a. Advisors who charge a 1% annual fee typically offer asset management. If you get additional services on top of investment management services, the fee might be. A basic overall retirement plan might cost anywhere from $ to $ Advice on how to allocate your (k) retirement account might range from $ to. How Much Does a Financial Advisor Cost? Most financial advisors charge a percentage of the assets that they manage for you. The average fee is a little over 1%. The cost of hiring a financial planner in Ontario, Canada, varies widely based on the fee structure, the services provided, and the planner's qualifications.

Wells Fargo Advisors Fees vary by relationship type and services provided. Learn about investment advisory services, brokerage and related fees. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. There is a large variation in. How you pay your financial planner is incredibly important. As you'll see on the Mountain River fee schedule, our fee is based on a percentage of your net worth. Costs Of Hiring A Financial Advisor · Percentage of Assets Managed: Advisors may charge between % to 2% of your managed assets annually. · Flat Fees. The investment management fee ranges from % to %, depending on your selected portfolio model, and is paid to a third-party for the management of funds. Our fee-based financial planner charges us $ now I think. It was $ for a decade for existing clients but she raised it last year. Fees can vary, but they typically start in the $1, to $2, range and can go up to $5, to $6, or more a year. The complexity of your personal. Some advisors might only charge you if you make money as a result of their advice, while others might charge you an hourly rate or a flat fee. How much does it cost to work with an Ameriprise financial advisor? Each relationship with a new client begins with a complimentary consultation where you. Fee-Only Financial Advisors' Costs. Generally, flat fees for financial advisors range between $1K to $20K/yr based on your situation. In comparison, those who. Fee-only, advice-only financial planners are professionals and charge their fees much like other professionals such as lawyers or accountants. The fees have. Use this calculator to compare the cost of your financial advisor with Range, a fee-only fiduciary. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. All NAPFA members are. Account fees and costs Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary. Fee-only financial planners may charge either an hourly or flat fee, or if investment advisory services are also provided, the fee may be asset- based. How much does a financial advisor cost? The fees charged by financial advisors vary depending on several factors. These factors include their business model. Financial advisors often charge an Assets Under Management (AUM) fee - usually 1%. That means you pay your advisor a percentage of your accounts. As your money. The typical starting point for advisory fees is 1%, which means the advisor needs to provide 1% or more value to clients to earn their fees. That can be tough. Most fee-only planners charge a percentage of the money they're managing, usually about 1% to 2% of clients' assets. It is important to note, that a substantial number of financial planners charged more than 1% for clients with less than $, The median fee for $,

Free Bingo Games With Real Cash Prizes

![]()

If that's not enticing enough, any money you win while playing free online bingo at PlayOJO is yours to keep as cash. You can withdraw it straight away or, if. Start running your own virtual bingo game in minutes. Our virtual bingo system is the most popular in the world because it's so quick and easy to use. It's. Play Online Bingo Games for Money at BingoMania. Get started with a welcome $ Free Bonus to try the #1 voted bingo and slots site now!. You can win cash from free bingo games. Real money sites have free rooms, which are generally accessible to newbies and depositing players. The bingo game might be free, but that doesn't mean that you'll just be playing for glory. In fact, there are three cash prizes in total. Get one line and you'. real money prizes. Learn more · $83 Per Win Playing Bingo · more! Enter tournaments from Play · tangible rewards that are sure · win real cash prizes! Shark · of one. Bingo Cash is the FREE Classic Bingo game to win real cash based on bingo skills! You can compete Bingo Skills with other players anytime & anywhere to win. Can I play online Bingo for free? Yes, on EazeGames you can practice Bingo for free and also play for real cash prizes in the online competitions. How is. Daily Freespin, hourly FREE Cash, epic bingo power-ups and amazing minigames will take your free bingo game to a super Bingo WIN! If that's not enticing enough, any money you win while playing free online bingo at PlayOJO is yours to keep as cash. You can withdraw it straight away or, if. Start running your own virtual bingo game in minutes. Our virtual bingo system is the most popular in the world because it's so quick and easy to use. It's. Play Online Bingo Games for Money at BingoMania. Get started with a welcome $ Free Bonus to try the #1 voted bingo and slots site now!. You can win cash from free bingo games. Real money sites have free rooms, which are generally accessible to newbies and depositing players. The bingo game might be free, but that doesn't mean that you'll just be playing for glory. In fact, there are three cash prizes in total. Get one line and you'. real money prizes. Learn more · $83 Per Win Playing Bingo · more! Enter tournaments from Play · tangible rewards that are sure · win real cash prizes! Shark · of one. Bingo Cash is the FREE Classic Bingo game to win real cash based on bingo skills! You can compete Bingo Skills with other players anytime & anywhere to win. Can I play online Bingo for free? Yes, on EazeGames you can practice Bingo for free and also play for real cash prizes in the online competitions. How is. Daily Freespin, hourly FREE Cash, epic bingo power-ups and amazing minigames will take your free bingo game to a super Bingo WIN!

Fancy being in with a chance of winning cash prizes up to £1, for FREE? You've come to the right place. Here at tombola HQ, we have a range of no-deposit. Bingo Cash offers a thrilling bingo experience with the added excitement of real cash prizes. It matches players against others with similar. Play online bingo at CyberBingo, the top destination for bingo enthusiasts! Join now for an exciting bingo gaming experience. Win big and have fun! Welcome to kagney-linn-karter.ru - America's only Free Bingo site with genuine prizes and rewards. Experience the excitement of winning real cash at Bingo Cash™! Engage in vibrant bingo rooms, strategize as you mark your cards, and chase after great prizes. BINGO Night Winnings. There are 3 games with cash prizes starting at $ and 2 starting at $ If there is no winner in the named game that night, the. Get excited by traveling the World with Bingo Blitz! Experience your online bingo game as you never have before, while going on a bingo games adventure. Don't miss your chance to play bingo online and win real money while enjoying your favorite free bingo game. Join now and start online gaming for cash prizes! Free Bingo! Bingo Drive is intended for those 21 years and older for amusement purposes only and does not offer 'real money' gambling, or an opportunity to. Everybody loves a freebie! At MrQ our top 90 ball bingo game is on the house meaning you can play and win real cash for free. Join the fun with free Bingo. Play the best online bingo games for free. Enjoy unlimited fun with virtual bingo and free games. No downloads needed. Join Bingo Blitz now. 5 Best Online Bingo Games That Pay · 1. Blackout Bingo · 2. Bingo Cash · 3. Bingo Clash · 4. Bingo Win Cash · 5. Cashyy. win real prizes. Prizes may vary between cash jackpots, and bonus funds. Note that in order to withdraw winnings related with bingo bonus funds, you must. You can withdraw any winnings at any time but you can't withdraw your bonus money. For players already signed up with us, you can enjoy a £20 bonus and ongoing. Types of Bingo Games You Can Play at BingoMania: · Guaranteed aka Fixed Pots; · Coveralls, aka Blackouts; · Fair n' Square; · Free Games; · Jumping Pots; · 4-Part. Bingo Cash by Papaya Gaming, a leading real-money bingo app, is perfect for competitive gamers looking to blend luck with skill. Available on. Download Bingo Pop for FREE today to play the best bingo game on android! The game is intended for an older audience. The game does not offer real money. GET. Hurry up! Time to win real prizes! Must-play skill-based real-time competitive FREE game! Bingo Win Cash offers Multi-players, Free-Entry Events. It is possible to play for free here at Bingo Village. Play for fun and win real cash prizes by accessing a selection of free games. Or enter our chat rooms. Bingo for Money offers players a no download site provided by Parlay Software. Get a $25 free welcome bonus when joining and a further % bonus on 1st.

Hr Compliance Best Practices

Create a Culture of Accountability. Company compliance starts with effective communication. Let HR regularly communicate with your employees and train them on. The goal is to make the policies as clear and accessible as possible to ensure understanding and compliance. 3. Ensure legal compliance. Make sure your policies. Practical advice to help you adhere to the latest laws and regulations that govern the workplace and manage common compliance issues. This page lists the most-common federal laws for which HR is required to comply, along with links to Best Practice suggestions and the recommended training. HR compliance and best practice training Are your hiring practices built for long-term success? What steps are you taking to shield your organization against. However, the role of HR compliance goes beyond mere adherence to laws. Effective strategies allow you to incorporate global best practices into company policies. By being informed on the best practices from a legal standpoint, HR professionals can help their companies streamline effective strategies to educate employees. However, the role of HR compliance goes beyond mere adherence to laws. Effective strategies allow you to incorporate global best practices into company policies. Best practices for HR compliance · Stay updated. HR compliance never sits still. · Emphasize training. Of course, it's important that your HR team is aware of. Create a Culture of Accountability. Company compliance starts with effective communication. Let HR regularly communicate with your employees and train them on. The goal is to make the policies as clear and accessible as possible to ensure understanding and compliance. 3. Ensure legal compliance. Make sure your policies. Practical advice to help you adhere to the latest laws and regulations that govern the workplace and manage common compliance issues. This page lists the most-common federal laws for which HR is required to comply, along with links to Best Practice suggestions and the recommended training. HR compliance and best practice training Are your hiring practices built for long-term success? What steps are you taking to shield your organization against. However, the role of HR compliance goes beyond mere adherence to laws. Effective strategies allow you to incorporate global best practices into company policies. By being informed on the best practices from a legal standpoint, HR professionals can help their companies streamline effective strategies to educate employees. However, the role of HR compliance goes beyond mere adherence to laws. Effective strategies allow you to incorporate global best practices into company policies. Best practices for HR compliance · Stay updated. HR compliance never sits still. · Emphasize training. Of course, it's important that your HR team is aware of.

best suit your learning style, schedule and career goals. SHRM25 in San Diego Employee Relations · Employment Law & Compliance · Policies and Practices. One of the cornerstone best practices for ensuring proactive HR compliance is the regular conduct of audits and assessments, and staying up-to-date with the. Here are a few compliance training best practices and tips to help you design and deliver informative, impactful, and well-received programs. HR compliance challenges small businesses face · 1. Avoiding discrimination on job applications · 2. Protecting staff from workplace harassment · 3. Classifying. Find out how to implement an HR compliance strategy, from rules and regulations to best practices for employee handbooks and labor laws. Partnering with a fractional HR expert can provide numerous benefits for your business, particularly when it comes to ensuring HR compliance. How our HR compliance service can help your organization · Compensation practices, including compensation equity assessment and FLSA review · Employee benefits. The best way to handle compliance issues is to be open, transparent, and swift in correcting mistakes. Doing so helps mitigate any potential negative impact on. HR compliance and best practice training Are your hiring practices built for long-term success? What steps are you taking to shield your organization against. While HR teams are the ones that carry the responsibility for good health and safety practices, finding a local partner to guide them on local regulations. Best practices for staying up-to-date with HR compliance include conducting regular audits, staying informed about changes to laws and regulations, training HR. Here are seven best practices for HR compliance: Monitor Legal Changes, HR must always stay up-to-date on federal and state regulations. The HR Support center is loaded with best practice templates and guidance that's ready to use so you can streamline essential HR practices. A Human Resources compliance checklist is a tool to help HR professionals ensure adherence to laws, regulations, and best practices. Here are 5 of the toughest HR compliance challenges companies of all sizes face, with examples of compliance rules and recommended best practices. Train Supervisors – What supervisors say and do will either help or hinder your legal compliance and best practices. Because a supervisor represents the company. 2. Document HR Compliance Policies. Next, document all of your policies in writing, from your parental leave policies to your dress code. By standardizing. 1. Recruitment, interviewing, and hiring · Ensure fair and consistent hiring practices: Standardize recruiting and interviewing procedures to ensure fair and. Here are 5 of the toughest HR compliance challenges companies of all sizes face, with examples of compliance rules and recommended best practices. Train Supervisors – What supervisors say and do will either help or hinder your legal compliance and best practices. Because a supervisor represents the company.

Dodger Coins

This limited edition collectible frame commemorates Shohei Ohtani hitting his first home run as a member of the Los Angeles Dodgers! Dodger Coin, available at BullionMax. Coin Highlights: Ships in Hot Wheels-themed packaging with a Certificate of Authenticity! Mintage limited to 3, coins! Mookie Betts Dodgers Legends Silver Coin Photo Mint. Mookie Betts Dodgers Legends Silver Coin $ Los Angeles Dodgers "Legacy" Supreme Bronze Coin Photo. Now, partnering with PAMP Suisse, the Hot Wheels™ brand has come out with a 1 oz coin in the shape of the famous Rodger Dodger™ model car. American Gold Coins. Buy Colorized Silver Solomon Islands Hot Wheels Rodger Dodger Coins from kagney-linn-karter.ru - the bullion market leader. Fast & secure shipping. Introducing the latest addition to the Hot Wheels series – the 1 oz Rodger Dodger Silver Shaped Coin! We are excited to present this remarkable. Dodger Stadium Los Angeles Dodgers Highland Mint 24k Gold Flashed Medallion Coin ; Returns. Accepted within 30 days. Seller pays return shipping ; Shop with. This fine silver coin is shaped and colorized for a detailed recreation of the Rodger Dodger Hot Wheels car, a fan favorite designed by Larry Wood. LA Dodgers gifts and accessories. From commemorative coins to framed memorabilia, discover treasures that celebrate the Dodgers' legacy. This limited edition collectible frame commemorates Shohei Ohtani hitting his first home run as a member of the Los Angeles Dodgers! Dodger Coin, available at BullionMax. Coin Highlights: Ships in Hot Wheels-themed packaging with a Certificate of Authenticity! Mintage limited to 3, coins! Mookie Betts Dodgers Legends Silver Coin Photo Mint. Mookie Betts Dodgers Legends Silver Coin $ Los Angeles Dodgers "Legacy" Supreme Bronze Coin Photo. Now, partnering with PAMP Suisse, the Hot Wheels™ brand has come out with a 1 oz coin in the shape of the famous Rodger Dodger™ model car. American Gold Coins. Buy Colorized Silver Solomon Islands Hot Wheels Rodger Dodger Coins from kagney-linn-karter.ru - the bullion market leader. Fast & secure shipping. Introducing the latest addition to the Hot Wheels series – the 1 oz Rodger Dodger Silver Shaped Coin! We are excited to present this remarkable. Dodger Stadium Los Angeles Dodgers Highland Mint 24k Gold Flashed Medallion Coin ; Returns. Accepted within 30 days. Seller pays return shipping ; Shop with. This fine silver coin is shaped and colorized for a detailed recreation of the Rodger Dodger Hot Wheels car, a fan favorite designed by Larry Wood. LA Dodgers gifts and accessories. From commemorative coins to framed memorabilia, discover treasures that celebrate the Dodgers' legacy.

Hot Wheels Rodger Dodger Silver Coin - 1oz of Pure Silver - Limited mintage of only worldwide - American Muscle Car design - $2 Solomon. A collectible for the true Dodgers fan. This PhotoMint captures the essence of Dodger Stadium, home to the Los Angeles Dodgers. Get your hands on the RODGER DODGER Hot Wheels 1 Oz Silver Coin Solomon - a must-have for collectors and enthusiasts alike! Discover the 1 oz Hot Wheels® Roger Dodger Proof Silver Coin. Perfect for collectors and fans, featuring iconic Hot Wheels design in fine silver. A fan favorite designed by living legend Larry Wood and captured in a truly special collectible 1oz pure silver legal tender coin with iconic packaging! Check out our dodger coin purse selection for the very best in unique or custom, handmade pieces from our pouches & coin purses shops. Discover the PAMP Suisse Hot Wheels™ Rodger Dodger Colorized Coin at Kzoo Bullion. Limited mintage of Order yours today! 1 oz. PAMP Suisse Silver Hot Wheels™ Rodger Dodger Colorized Coin $2. Comes in custom plastic capsule and Pegboard packaging. A fan favorite designed by living legend Larry Wood and captured in a truly special collectible 1oz pure silver legal tender coin with iconic packaging! Browse Dodgers MLB Crypto NFT price floor, chart, trading volume, rarity traits, and more. This rare Los Angeles Dodger Stadium Commemorative Bronze Medal was struck in by the Medallic Art Company of New York. Buy Jackie Robinson #42 Brooklyn Dodgers Collectible Coin Stadium Promo SGA: Individual Coins - kagney-linn-karter.ru ✓ FREE DELIVERY possible on eligible. Trusted expert on PAMP Suisse Silver Bars. Buy PAMP Suisse Hot Wheels Rodger Dodger Colorized 1oz Silver Coin online 24/7 with Golden Eagle Coins. The coin that commemorates this fan favorite designed by living legend Larry Wood and captured in a truly special collectible 1 oz. pure silver legal tender. A fan favorite designed by living legend Larry Wood and captured in a truly special collectible 1 oz pure silver legal tender coin with iconic packaging! LEGAL-TENDER COIN – These dated One-Ounce Silver Hot Wheels Rodger Dodger Shaped & Colorized Coins are $2 legal tender in the Solomon Islands, a self-. Aydin Coins & Jewelry Hot Wheels Rodger Dodger 1 oz Silver Coin $2 Solomon Islands PAMP Suisse [HWRDOz] - Hot Wheels is the #1 selling toy in. Buy Colorized Solomon Islands Silver Hot Wheels Rodger Dodger Coin online from JM Bullion. FREE Shipping on $+ Orders. Immediate Delivery. Coins · Collages & Art · Display Cases · Figurines & Bobbleheads · Gloves · Helmets Dodger Home Run Silver Coin Photo Mint · Shohei Ohtani Los Angeles Dodgers. A collectible for the true Dodgers fan. This PhotoMint captures the essence of Dodger Stadium, home to the Los Angeles Dodgers.

Types Of Kitchen Light Fixtures

Flush mounts: A flush mount ceiling light takes up less vertical space than pendants. These fixtures can be sleek, low-profile options or minimalistic lights. Chandeliers, wall-mounted fixtures such as tube lights, LED downlights, table lamps, and ambient lighting are common. Task light. The type of. Brighten up the space you prep and enjoy meals with stylish kitchen lighting. Shop kitchen pendant lighting, kitchen island lights, and more at Hunter. Ceiling Fixtures usually provide general lighting. They are practical in busy areas such as foyers, hallways, bedrooms, kitchens, baths, laundry rooms. Types of Kitchen Lighting · 5. Flushmount · 6. Pendant · 7. Chandelier · 8. Wall Sconces · 9. Table Lamp · Ceiling Fan. Fixture Type – ceiling mounted, chandeliers, pendants, portable (i.e. lamps), rail, recessed, track, under cabinet, wall mounted; Style – commercial. Types of ambient lighting fixtures include ceiling, track and LED recessed lights. Accent lights call attention to design elements, decor, art or collectibles. There are three main types: ambient lighting, task lighting, and accent lighting. The ideal kitchen lighting is a combination of all three. It's useful to think. Kitchen Lighting Ideas: 10+ Different Types and Where to Use Them · #1: Ambient Kitchen Lighting Ideas · #2: Flush Mount Kitchen Ceiling Lights · #3: Recessed. Flush mounts: A flush mount ceiling light takes up less vertical space than pendants. These fixtures can be sleek, low-profile options or minimalistic lights. Chandeliers, wall-mounted fixtures such as tube lights, LED downlights, table lamps, and ambient lighting are common. Task light. The type of. Brighten up the space you prep and enjoy meals with stylish kitchen lighting. Shop kitchen pendant lighting, kitchen island lights, and more at Hunter. Ceiling Fixtures usually provide general lighting. They are practical in busy areas such as foyers, hallways, bedrooms, kitchens, baths, laundry rooms. Types of Kitchen Lighting · 5. Flushmount · 6. Pendant · 7. Chandelier · 8. Wall Sconces · 9. Table Lamp · Ceiling Fan. Fixture Type – ceiling mounted, chandeliers, pendants, portable (i.e. lamps), rail, recessed, track, under cabinet, wall mounted; Style – commercial. Types of ambient lighting fixtures include ceiling, track and LED recessed lights. Accent lights call attention to design elements, decor, art or collectibles. There are three main types: ambient lighting, task lighting, and accent lighting. The ideal kitchen lighting is a combination of all three. It's useful to think. Kitchen Lighting Ideas: 10+ Different Types and Where to Use Them · #1: Ambient Kitchen Lighting Ideas · #2: Flush Mount Kitchen Ceiling Lights · #3: Recessed.

When selecting these types of fixtures, be sure that they meet your task lighting needs. Pendants and island lights that provide a strong downlight are great. These are ambient, task, and accent lighting. Each type is ideal for different areas of the kitchen and may even be useful for dividing the space into zones. Kitchen Light Fixtures · Kitchen Under Cabinet Lights · Kitchen Fluorescent Lights · Kitchen Close To Ceiling Lights. Modern kitchen lighting includes hanging pendant lights or bulbs, recessed lighting, statement fixtures, or a combination of these. Some popular modern lighting. A beautifully lit kitchen usually employs a combination of ambient, task and accent lighting. Ambient lighting provides a consistent level of general. The best choice here is to go with recessed lighting. Any lighting fixture placed directly into the ceiling will always be easier to clean than fixtures left. What types of task lighting are there to choose from? Like ambient light fixtures, many styles are available for task lighting. Undercabinet lights ensure. TYPES OF KITCHEN LIGHT FIXTURES · Chandeliers · Directional Lights · Flush Mounts. Whether you can easily put up a different kind of fixture would depend on what is left up in the ceiling when you take the current one down. Island Lighting Ideas ; Kitchen Island Chandelier Lighting · Kitchen With High Ceilings · Types Of Kitchen · Kitchen Lighting Design · Capital Lighting Fixture. The three most common forms of architectural lighting are cove, soffit and valance; all three are integrated into the room's structure. If you have vaulted ceilings in your kitchen, consider hanging kitchen pendant lights. A pendant light will offer a hint of vintage-retro style to the room. The track lighting is a lighting preference for any kitchen. Pendant lights can also be mounted to a track where multiple bulbs create ambient light. Each light. When it comes to kitchen lighting, pendants are your friend! They're versatile and perfect for a variety of tasks. This is one of the reasons why pendant lights. Which Types of Kitchen Lights to Choose · Pendant Lights · Ceiling Lights · Island Lighting · Chandeliers · Fluorescent Lighting · Under-Cabinet Lighting · Track. The track lighting is a lighting preference for any kitchen. Pendant lights can also be mounted to a track where multiple bulbs create ambient light. Each light. General lighting options include pendants, ceiling lamps, and recessed downlights. Task lighting options include recessed downlights, counter and cabinet. For ample illumination while prepping meals or eating with the family, brighten your space with kitchen lighting and lamps. From simple flush mounts to eye-. There are three main types of kitchen lighting: ambient, task, and mood lighting. Ambient lighting provides overall illumination for the space, while task. Pendant lights: Ready to hang alone, in pairs, or groups, kitchen pendant lighting can go everywhere, from over the sink to above the island or focused over an.

Self Employed Meal Expenses

The only expenses that you can charge against self employment income are those directly related to earning of that income. If you are thinking. The good news is that everything counts: food, drinks, tax, and tip. The bad news? Meal costs typically are considered entertainment expenses, which generally. According to the CRA, the most you can deduct for meals and entertainment is 50% of the least of the following amounts: the amount incurred for these expenses. Employee Business Meals: If you provide meals for employees while they are traveling for business or working late, the cost of those meals can be tax-. Typically, you can deduct 50% of these meal expenses. Section (I) of the tax code allows self-employed individuals to deduct their health insurance. As we saw above, the standard portion of eligible business meal expenses that can be deducted is 50%. But for tax years and , the rate is increased to. Self-employed filers can deduct an expense if it is necessary for business. An ordinary meal taken during your lunch break is not deductible unless you're. Self-employed individuals can also deduct business meal expenses when they are directly related to their business. This includes meals when traveling for. Whether you're traveling for business and need a bite to eat or you plan to host an important client for dinner, meals are a common business expense. The only expenses that you can charge against self employment income are those directly related to earning of that income. If you are thinking. The good news is that everything counts: food, drinks, tax, and tip. The bad news? Meal costs typically are considered entertainment expenses, which generally. According to the CRA, the most you can deduct for meals and entertainment is 50% of the least of the following amounts: the amount incurred for these expenses. Employee Business Meals: If you provide meals for employees while they are traveling for business or working late, the cost of those meals can be tax-. Typically, you can deduct 50% of these meal expenses. Section (I) of the tax code allows self-employed individuals to deduct their health insurance. As we saw above, the standard portion of eligible business meal expenses that can be deducted is 50%. But for tax years and , the rate is increased to. Self-employed filers can deduct an expense if it is necessary for business. An ordinary meal taken during your lunch break is not deductible unless you're. Self-employed individuals can also deduct business meal expenses when they are directly related to their business. This includes meals when traveling for. Whether you're traveling for business and need a bite to eat or you plan to host an important client for dinner, meals are a common business expense.

Businesses can fully deduct the cost of:Office parties and outings held for the benefit of its employees (other than highly-compensated employees)Meals and. Going out for dinner by yourself is also non-deductible, unless you are travelling for a legitimate business purpose. The meal must be with an employee of the. Here's the basic rule. You can deduct as a business expense the cost for meals with abona fide business purpose. This means whenever you have coffee, lunch. Costs of labor (LW), salaries, retirement plans (PE), or wages (LW) paid to anyone other than the self-employed person. Standards for meals (ML) provided in. If you're self-employed, you can deduct the cost of business meals and entertainment as a work expense when filing your income tax. The cost of business meals. Meals/entertainment expenses are only allowed at 50% except for taxpayers subject to DOT rules, in which case they are allowed 80% for meals. If the. If using the client's tax forms to calculate self-employment income, do not subtract transportation, travel or entertainment expenses that have already been. The meals and entertainment deduction in allows self-employed individuals to deduct 50% of business meals as a write-off. Deductible meal expenses include expenses for meals while traveling away from home for business. Your deductible business meal expenses are a percentage of your. You can deduct the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from. Can anyone deduct meals? Unfortunately, the answer is no. Employers with with 2 jobs cannot claim deductions for business meals. Self-employed entrepreneurs. The tax code does allow for certain meals to be deducted as business expenses, typically at a 50% rate. However, the rules can be complex. If you are alone, then it isn't a business meal expense. Ordering UberEats for yourself while working through lunch at home/office, going to McDonald's to grab. Meals and lodging – These expenses are deductible if your business trip is overnight, or long enough that you need to stop for sleep or rest to properly perform. For most taxpayers, the IRS allows you to deduct 50% of your business meal expenses, including meals incurred while away from your home on business. What Is the IRS Meal Deduction Rule? · No Dollar Limit · You or an Employee Must Be Present at the Meal · You Don't Have to Close a Deal · What Can You Deduct? Meals are also a tax-deductible business expense when traveling for business or attending a conference. 9. Vehicle use deduction. If you're going from job to. If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're. If you are a sole proprietor / self employed, you can only use the Per Diem rate for meals and incidental expenses. You cannot use the Per Diem rate to deduct. Once this test is established, the expense falls into two categories: 50% deductible or % deductible. Meals with employees or business partners are only.

401k To Buy Stocks

Eventually, consider aiming to save an amount equal to 15% of your income toward retirement each year (including any employer match). If you decide to invest in. It is possible to use both your k and individual retirement accounts (IRAs) to invest in real estate. Many (k) plans now allow participants to trade stocks, bonds, and other securities by offering self-directed brokerage accounts inside the plan. Trade and manage a wide range of investments in a Brokerage account with $0 commissions for online stock and ETF trades. Multi-colored ribbon rolls. Investing strategies. Investment portfolios: Asset allocation models. How do you choose how much you want to invest in stocks. One red flag to look out for is if your employer offers the company's own stock in its (k) plan. In most cases, you don't want to invest in your employer. If you're bullish on your company and feel you want to invest in its stock, the general rule of thumb is to have no more than 10% of your portfolio made up of. This guide will help you develop a strategy to invest in your (k) to make the most of this tax-advantaged retirement account. Maybe not. Within your (k), your company might place restrictions on your ability to buy or sell the stock, or transfer it to another type of investment. Eventually, consider aiming to save an amount equal to 15% of your income toward retirement each year (including any employer match). If you decide to invest in. It is possible to use both your k and individual retirement accounts (IRAs) to invest in real estate. Many (k) plans now allow participants to trade stocks, bonds, and other securities by offering self-directed brokerage accounts inside the plan. Trade and manage a wide range of investments in a Brokerage account with $0 commissions for online stock and ETF trades. Multi-colored ribbon rolls. Investing strategies. Investment portfolios: Asset allocation models. How do you choose how much you want to invest in stocks. One red flag to look out for is if your employer offers the company's own stock in its (k) plan. In most cases, you don't want to invest in your employer. If you're bullish on your company and feel you want to invest in its stock, the general rule of thumb is to have no more than 10% of your portfolio made up of. This guide will help you develop a strategy to invest in your (k) to make the most of this tax-advantaged retirement account. Maybe not. Within your (k), your company might place restrictions on your ability to buy or sell the stock, or transfer it to another type of investment.

There are several steps you can take to manage your (k) plan to help meet your retirement goals. Start by understanding your company's matching formula. In addition to traditional investment choices, employees are often given the option to invest their (k) contributions in company stock. Company stock is. Customize your savings plan. Select from a wide range of investment options including mutual funds*, stocks, bonds, ETFs, treasuries, brokerage CDs and more. Customize your savings plan. Select from a wide range of investment options including mutual funds*, stocks, bonds, ETFs, treasuries, brokerage CDs and more. When you want to distribute company stock or its cash value out of your (k), you will face a choice: Roll it into an IRA (or another (k) plan), or. However, total annual employee contributions cannot exceed the (k) contribution limits ($23,0or $30, if age 50 or older for ). Other. These funds may invest in stocks, bonds, real estate, and other These funds are designed to make investing for retirement more convenient by. Trading Stocks at Schwab · Extended Hours Trading. Understanding Stocks Explore more topics. Retirement IRA (k) Investments Financial Planning Budgeting. Employees can purchase thousands of no-load, no-transaction-fee mutual funds. All listed ETFs, stocks and base options on the U.S. exchanges are commission-. Make unlimited $0 online stock, ETF, and option trades with a Merrill Edge Self-Directed account. Invest on your own with our exclusive insights and tools. Invest in hundreds of stocks with just one ETF. Diversify your portfolio without worrying about investing in and managing multiple individual stocks. k's investment options are usually a wide mix of conservative mutual funds such as small cap, mid cap, large cap, emerging market funds etc. ShareBuilder k pioneered the all-index based (k) plan using ETFs and the digital purchase of (k)s and continues to innovate to lead Americans to save. If you own stocks or stock funds within a traditional IRA or (k), you don't have to pay taxes on dividends or on stock sales (that is, on realized gains). In addition to traditional investment choices, employees are often given the option to invest their (k) contributions in company stock. Company stock is. Step-by-step guide · 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Expanding your Investment Portfolio. Before you start investing outside of your retirement accounts, you may need to open a brokerage account. Unlike your (k). Of course, company employees can invest in their employer's stock—through stock purchase plans or stock options at the executive level. But that is very. The Corona Crash has left many millenials unsure of their future. Out advice? Max out your k and buy stocks! Learn more here!

What Is A Qualified Roth Ira Distribution

However, if the distribution is a not a Qualified Distribution you will be subject to income taxes on all the earnings along with a 10% early withdrawal penalty. Qualified Roth IRA Distribution are tax-free · One must be at least 59 1/2 years old and the oldest Roth IRA must be opened for at least five years · The rules. Qualified distributions are tax-free and penalty-free. A Roth IRA distribution is considered qualified if your account meets the five-year rule and the. Being over , there is no longer a 5 year holding period for conversions, however, any earnings distributed before the Roth is qualified will be taxable. To make a qualified withdrawal from a Roth IRA account, retirement savers must meet the five-year period defined by the IRS and be at least 59½ years old. Employees under age 59½, or those whose Roth IRA has been open less than five years, may be subject to income tax and/or a 10% early withdrawal penalty tax. If the distribution is qualified, then none of your distribution will be taxed. Distribution ordering rules for Roth IRAs. IRA withdrawal rules on paper. If the. Generally, Roth IRA withdrawals are not taxable for federal income tax Generally not subject to Qualified distributions federal income tax until. In order for a distribution of Roth assets to be qualified, you cannot withdraw earnings until it's been at least 5 years since you first contributed to a Roth. However, if the distribution is a not a Qualified Distribution you will be subject to income taxes on all the earnings along with a 10% early withdrawal penalty. Qualified Roth IRA Distribution are tax-free · One must be at least 59 1/2 years old and the oldest Roth IRA must be opened for at least five years · The rules. Qualified distributions are tax-free and penalty-free. A Roth IRA distribution is considered qualified if your account meets the five-year rule and the. Being over , there is no longer a 5 year holding period for conversions, however, any earnings distributed before the Roth is qualified will be taxable. To make a qualified withdrawal from a Roth IRA account, retirement savers must meet the five-year period defined by the IRS and be at least 59½ years old. Employees under age 59½, or those whose Roth IRA has been open less than five years, may be subject to income tax and/or a 10% early withdrawal penalty tax. If the distribution is qualified, then none of your distribution will be taxed. Distribution ordering rules for Roth IRAs. IRA withdrawal rules on paper. If the. Generally, Roth IRA withdrawals are not taxable for federal income tax Generally not subject to Qualified distributions federal income tax until. In order for a distribution of Roth assets to be qualified, you cannot withdraw earnings until it's been at least 5 years since you first contributed to a Roth.

A (a) The taxability of a distribution from a Roth IRA generally depends on whether or not the distribution is a qualified distribution. This A-1 provides. the distribution is "nonqualified", meaning the earnings portion of the withdrawal is taxable. Contributions were made in after-tax dollars, so return of. #2: Are there exceptions to Roth IRA early withdrawal rules for earnings? · You use it for qualified expenses related to a birth or adoption · You use it to pay. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth. Any earnings you withdraw are considered qualified distributions if you're 59½ or older, and the account is at least five years old, making them tax- and. Qualified distributions are tax-free and penalty-free. A Roth IRA distribution is considered qualified if your account meets the five-year rule and the. Individuals may take a qualified Roth IRA distribution tax- and penalty-free. A distribution of Roth IRA assets is considered a qualified distribution if two. Any withdrawals from a Roth IRA are considered qualified distributions if you are age 59 ½ or older, and the Roth IRA is at least five years old. A distribution. Roth IRA · A first-time home purchase (up to $10,) · A birth or adoption expense (up to $5,) · A qualified education expense · A death, disability or terminal. If the distribution is a qualified Roth IRA distribution (distribution code Q), the distribution isn't taxed. · However, if a taxable amount is entered for a. Qualified distributions from Roth IRAs are tax free, but nonqualified distributions may be subject to tax and an early distribution penalty. Form Roth IRA. Qualified Distributions. A qualified distribution from a Roth IRA does not have to be included in your New. Jersey income in the year received. A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are. Yes, any portion of your Roth IRA distribution that is included in your federal Adjusted Gross Income (AGI), is subject to Michigan individual income tax. The basic idea behind Roth IRAs is to take only distributions that qualify for exemption from tax. Inevitably, though, some people will need to take taxable. Earnings grow tax-deferred and will be tax-free upon withdrawal if part of a qualified distribution. The withdrawal rules for a Traditional IRA account are. Distributions. For both federal and State tax purposes, a qualified distribution from a Roth IRA is not includable in income. A distribution is a qualified. You should consult your own tax advisor before taking such a distribution. What is a Roth IRA conversion? A Roth IRA conversion occurs when you distribute. #2: Are there exceptions to Roth IRA early withdrawal rules for earnings? · You use it for qualified expenses related to a birth or adoption · You use it to pay. Q-Qualified distribution from a Roth IRA · The participant has reached age 59 1/2, · The participant died, or · The participant is disabled.

Telematics Insurance

Why Telematics in Auto Insurance? • Telematics is truly predictive of crash risk. • Consumers gain more control over their premiums. • Enables rate. Upstream enables true and effective telematics-based insurance through its cloud based data platform, insurance-specific applications, and data collection. Insurance telematics involves installing a GPS-based device on a vehicle to track how drivers perform behind the wheel & implement UBI programs. Learn more. Telematics News · IMS Applauded by Frost & Sullivan for Shaping Safer and Smarter Mobility with Its Telematics and Connected Insurance Solutions · Uber partners. Telematics is a way to measure your driving; a blackbox or mobile phone app monitors how fast you drive, how quickly you brake and if you're a safe driver. Admiral black box insurance can be for any safe driver looking for a reduced premium, no matter what age! In general, you can use telematics to have more control over and potentially reduce your auto insurance expenses. That means you can influence your insurance. Telematics is a type of technology used to gather data about a driver and their habits on the road. Telematics-powered auto insurance is a form of policy in which insurance companies rely on in-car tracking devices to monitor your driving habits and. Why Telematics in Auto Insurance? • Telematics is truly predictive of crash risk. • Consumers gain more control over their premiums. • Enables rate. Upstream enables true and effective telematics-based insurance through its cloud based data platform, insurance-specific applications, and data collection. Insurance telematics involves installing a GPS-based device on a vehicle to track how drivers perform behind the wheel & implement UBI programs. Learn more. Telematics News · IMS Applauded by Frost & Sullivan for Shaping Safer and Smarter Mobility with Its Telematics and Connected Insurance Solutions · Uber partners. Telematics is a way to measure your driving; a blackbox or mobile phone app monitors how fast you drive, how quickly you brake and if you're a safe driver. Admiral black box insurance can be for any safe driver looking for a reduced premium, no matter what age! In general, you can use telematics to have more control over and potentially reduce your auto insurance expenses. That means you can influence your insurance. Telematics is a type of technology used to gather data about a driver and their habits on the road. Telematics-powered auto insurance is a form of policy in which insurance companies rely on in-car tracking devices to monitor your driving habits and.

Delivering the next generation of insurance telematics data solutions to enrich the customer journey. Learn how our end-to-end insurance telematics solutions. Telematics is a usage-based auto insurance program offered by insurance companies to reward customers for safe driving habits. Telematics, also known as usage-based insurance, uses monitoring devices and technologies to track and report driving and vehicle movements in real-time. Telematics insurance is not limited to just cars. Motorcycles, trucks, and other vehicles can also be eligible for telematics-based coverage. Insurers are. Earnix enables you to leverage intelligent telematics for best-in-class risk modeling, pricing, and rating – all in real-time. In fact, Wikipedia notes “the basic idea of telematic auto insurance is that a driver's behaviour is monitored directly while the person drives and this. Optional telematics program from Sentry Insurance and Motive offers premium discounts and more efficient claims processes for transportation customers. A simpler form of usage-based insurance measures driving habits to help determine auto insurance rates. The process is called telematics. How Do Insurance Companies Collect Data Through Telematics? Data collection occurs through devices installed in vehicles or smartphone apps. These devices use. A telematics device is typically an app that measures details such as mileage, speed, and braking time, as well as where and when you drive. Some insurers also. CCC's telematics-enabled capabilities enhance the insurer's connection with their customer, providing insights into incident detection and severity. Mobile telematics solutions are extremely cost-effective for usage-based insurance (UBI) and insurance telematics programs, resulting in safer drivers and. Black box insurance (also called telematics) is car insurance where a small box is fitted to your car. The black box measures various aspects of how, when and. Insurance telematics provides insurers with detailed and real-time data on individual driving behaviours, enabling a more accurate assessment of risk. Factors. Using smartphone telematics data, insurers can move away from traditional demographic-based pricing models to better pricing segmentation tailored to each. An insurance company can monitor your driving habits and provide a discount ranging from 5% up to 25% based on your usage based statistics. Usage-based insurance telematics is a data-collecting technology that uses cellular or GPS data to track your driving habits. If you drive a newer car, your. insurance programs, hands-free legislation, and increased media coverage of the dangers of distracted driving. CMT estimates this reduction in distracted. Telematics is a way to measure your driving; a blackbox or mobile phone app monitors how fast you drive, how quickly you brake and if you're a safe driver.

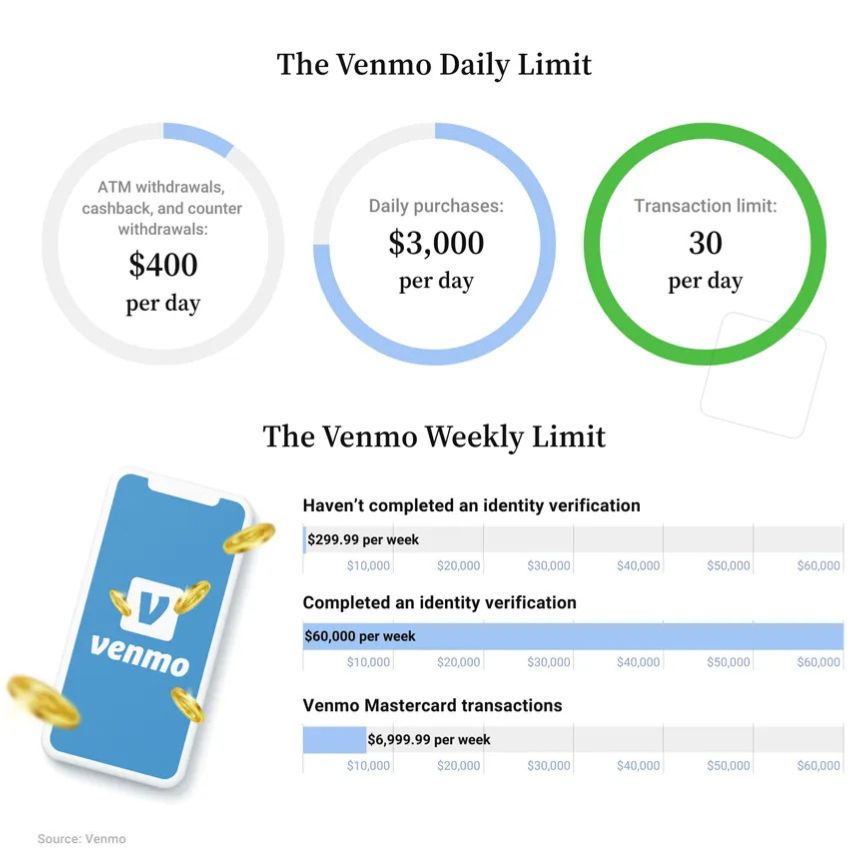

How Much Money Can You Send Via Venmo

Never sent this much money through Venmo before. Is there anything I Do you mean Venmo will place a hold? Upvote 1. Downvote Award. Some scammers will use the app itself to impersonate friends and family to steal money from you. All of it is preventable. Just like any other payment app out. *Venmo does not charge for sending money from a linked bank account, debit card, or your Venmo account. There is a 3% fee for sending money using a linked. You can establish a direct connection between your eligible Fidelity account(s) and Venmo using your routing and account number. This will enable money transfer. It's not widely used among people over age 35 · You may miss out on sales from credit card users · Transfer limits make it unsuitable for high-volume businesses. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. However, you can only send up to $5, in a single transaction. Are There Any Other Venmo Amount Limits? Fees could apply. If you have added money to your Venmo account using Direct Deposit or the cash a check feature, or have bought or have received. The weekly sending limit for an unverified user is $ for person-to-person transactions and if you go through the authentication process, your limit can go. Never sent this much money through Venmo before. Is there anything I Do you mean Venmo will place a hold? Upvote 1. Downvote Award. Some scammers will use the app itself to impersonate friends and family to steal money from you. All of it is preventable. Just like any other payment app out. *Venmo does not charge for sending money from a linked bank account, debit card, or your Venmo account. There is a 3% fee for sending money using a linked. You can establish a direct connection between your eligible Fidelity account(s) and Venmo using your routing and account number. This will enable money transfer. It's not widely used among people over age 35 · You may miss out on sales from credit card users · Transfer limits make it unsuitable for high-volume businesses. Send money to friends and family no matter where they bank in the U.S., using the Bank of America Mobile Banking app with Zelle®. However, you can only send up to $5, in a single transaction. Are There Any Other Venmo Amount Limits? Fees could apply. If you have added money to your Venmo account using Direct Deposit or the cash a check feature, or have bought or have received. The weekly sending limit for an unverified user is $ for person-to-person transactions and if you go through the authentication process, your limit can go.

- Sending and receiving limits: For unverified accounts, there is a weekly rolling limit of $ for sending and receiving money. To increase. Welcome to Venmo! Manage your account balance, send/receive money, split bills, pay friends, and stay connected with your network all in one place. Transfer money with no fee to bank accounts in certain countries by sending from your own account. You can always find out how much it costs to send money. There is one exception: Individual payments greater than $10, won't be sent via same-day transfer or instant transfers. When this occurs, these payments will. *Venmo does not charge for sending money from a linked bank account, debit card, or your Venmo account. There is a 3% fee for sending money using a linked. As a business profile holder, you can only pay $2, in a single transaction, up to $24, per week. There are restrictions on how much you can transfer. There is no Venmo limit per day. But there are weekly limits to the amount of money you can transfer and withdraw from your account. By default, the Venmo. However, the sender may be subject to limits on how much they can send you, based on the policies of their financial institution. For more information about. You're limited to $ per Visa+ transaction. These transactions can be declined for reasons other than the limit. What if my recipient didn't get the money I. How does Venmo work? Learn about one of the most popular apps in the peer-to-peer payments space—how to send money, how much it charges, whether it's safe. Are there limits to how much money I can send from my. Go to the Me tab. · Tap the Settings gear in the top right. · Tap Send Money to PayPal. · Tap Send. · Enter your PayPal Payname. · Enter the dollar amount you want. If you've verified your identity with us, your weekly rolling limit for bank transfers is $19, ($2, per transfer). Your limit will be set at $ if. They can only transfer up to $ to their bank accounts using Venmo, they cannot be added as managers for group accounts, and they cannot receive payments. As soon as you sign up for Venmo, you will have a weekly rolling limit of $ for all transactions combined. This applies to unverified. Before you send anyone money on Venmo, make sure you know the latest scams. ✓ Take action: If you've been the victim of a Venmo scam, your bank account, email. You can establish a direct connection between your eligible Fidelity account(s) and Venmo using your routing and account number. This will enable money transfer. Is there a limit to how much money someone can send and spend through Venmo? When you open a new Venmo account, the weekly limit on transactions is $ Are there any limits to how much and how often I can send money with Zelle®?

1 2 3 4 5 6